Sub-Saharan Africa is the only region in the world where women make up the majority of entrepreneurs. But, delve a little deeper and you will find that women face steep social and economic barriers to growing their businesses. While access to finance is the key constraint, they are also much more likely to be hindered due to household responsibilities and are less likely to have the market skills to advance their businesses. Removing these barriers could unleash a huge opportunity for women entrepreneurs and boost economic growth in the region.

The European Investment Bank (or EIB) launched the African Women Rising Initiative (AWRI) to support women’s economic empowerment in Sub-Saharan Africa by identifying effective environments for growth, increasing access to finance, and supporting women entrepreneurs in selected countries. The AWRI aims to strengthen women-led or -owned businesses through designing holistic, market-oriented programs, bolstering business skills, and developing gender intelligent financial services.

As a first step for the AWRI, ConsumerCentriX (CCX), as part of the Consortium with German-based technical advisory group IPC and African Management Institute (AMI), set out to identify the strongest opportunities for impacting women entrepreneurs in Africa. CCX conducted a comprehensive mapping exercise that assessed the current state of financial inclusion for women, women’s entrepreneurship and empowerment initiatives, as well as innovations in financial technology, and digital banking. Based on this exercise, the team identified countries in the region that have substantial gaps in gender equality and women’s economic empowerment, however, their macro and social environments could enable a financial sector intervention that fosters progress.

Mapping Methodology

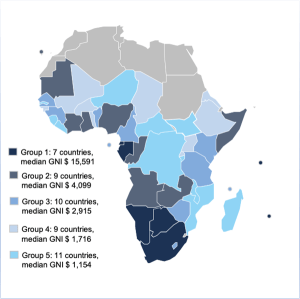

Women entrepreneurs are not evenly distributed across Sub-Saharan Africa. The region is made up of 48 countries at varying stages of development and some places offer a more conducive environment for women entrepreneurs to grow their businesses with the support of formal financial services. In order to better understand women’s financial and economic inclusion opportunities, we created a scoring system based on 65 publicly available indicators from sources such as the Global Findex[1]. Not all countries in Sub-Saharan Africa were surveyed by the Findex which limited the comparable data, but in many cases, other indicators were able to be substituted from other sources like the World Bank, International Monetary Fund, the Organization for Economic Co-operation and Development, Economist Intelligence Unit, as well as Citibank and Mastercard data that illustrate macroeconomic, demographic, political-regulatory, and socioeconomic dynamics within each country. Additional sector-specific datasets contributed a broader understanding of the stage of development and inclusiveness of the financial sector. We then ranked each country according to their stage of development as indicated by the gross national income (GNI) per capita and compared them based on the indicators.

The indicators were categorized into four overarching themes that tested each country’s receptivity to potential financial inclusion efforts based on their legal or socio-cultural constraints and women’s access to finance. The categories included:

- Enabling Environment: Provided a snapshot of each country’s development stage by assessing the general economic and demographic environment through indicators like conflict, debt, GNI per capita and GDP, and population characteristics;

- Women’s Inclusion and Human Capital: Assessed women’s socio-economic position including factors that influence their productivity and opportunity to build capital;

- Women’s Entrepreneurship: Analyzed the ease of doing business in each country and women’s typical role within the small and medium-sized enterprise (SME) sector; and

- Financial Sector: Focused on the availability of financial services through different channels, the regulatory environment, and the sector’s inclusivity and capacity to serve entrepreneurs with financing.

Ultimately, the CCX team created an effective tool that swiftly facilitates benchmarking of countries in Africa (and beyond) for our work on impact consulting in women’s financial inclusion and entrepreneurship support. Additionally, the tool includes permanent links to the respective databases utilized for the mapping exercise.

Results

During the mapping exercise, 19 countries were immediately omitted from the selection process based on insurmountable obstacles to a long-term technical assistance engagement like extensive violent conflict and significant debt distress. Countries with extremely small populations were also not carried onto the shortlist due to their lack of scalability and potential impact.

In order to narrow the playing field even further, we categorized countries in Sub-Saharan Africa into five groups based on their development stage. Each country was ranked according to threshold criteria against peer countries within each group. Countries were excluded from consideration if the socio-economic challenges or gender gaps they were facing could not be realistically addressed with financial inclusion or women’s economic empowerment initiatives. To advance to the next round, countries needed to score 60-70% on average across all indicators when compared to the top country within each group.

Countries that met the threshold had significant room for improvement in women’s entrepreneurship and inclusivity in the formal financial sector that could be addressed by the areas intended for the AWRI technical assistance, namely empowering women entrepreneurs and creating gender-intelligent and innovative SME financing solutions. In other words: these countries indicated a substantial potential for growth compared to their best-in-class African peers, while also presenting a sufficiently conducive environment for impact through the AWRI support.

Based on this scoring system, a shortlist of 16 countries qualified including Benin, Burkina Faso, Democratic Republic of Congo, Cameroon, Côte d’Ivoire, Ghana, Kenya, Lesotho, Liberia, Madagascar, Mozambique, Nigeria, Rwanda, Senegal, and Uganda.

EIB selected Côte d’Ivoire, Rwanda, Senegal, and Uganda were selected as the four finalists. These countries have healthy percentages of SMEs t

hat are women-led or -owned, have financial institutions with existing relationships with EIB that are interested in better serving women entrepreneurs, show strong potential for growth with existing conducive regulatory and social environments and/or the opportunity to leverage digital channels to deepen financial inclusion and women’s economic empowerment.

Below is brief overview of the four finalist countries:

- Côte d’Ivoire is the business hub of French-speaking West Africa with strong prevalence of private business and self-employment with an established financial sector, fast-growing microfinance activity and strong digital uptake;

- Rwanda has high women’s labor force participation (84%) and a supportive public sector, a national financial inclusion strategy and investment climate which offers strong opportunities for digitization;

- Senegal is a majority Muslim country that has a relatively high degree of gender equality in early-stage entrepreneurship, with a high share of female entrepreneurship and strong remittances which could serve as a source of funding for women business owners; and

- Uganda is an attractive market for business investment given its stable economy, large market, and the size of its labor force with a financial inclusion strategy that is generally supportive of women’s economic activities.

The mapping exercise was successful in identifying countries in the region that are more favorable to women’s economic inclusion and empowerment and serves as a useful tool for understanding country contexts in the financial sector in other regions throughout the world.

Women in Sub-Saharan Africa face universal constraints as entrepreneurs and EIB’s AWRI program will now support organizations that can increase women’s financial inclusion by developing quality programs involving access to finance, training and other non-financial services to support woman entrepreneurs’ growth.

[1] The Global Findex is a publicly available data set on how adults save, borrow, make payments and manage risk that is published every three years by the World Bank. Data is collected in partnership with over 140 economies through nationally representative surveys.