WSME Segmentation Report, Framework And Toolkit

This Toolkit, which accompanies the Women-owned/led Small and Medium Enterprise(WSME) Segmentation Report, provides a step-by-step guide, enabling local financial intermediaries to develop customized lending and financial products that align with the specific needs of each WSME segment, funders to assess risk and allocate funding to support high-potential WSMEs, and business support organizations (BSOs) to design tailored programs that address challenges specific to each segment. This practical resource includes guides and downloadable tools across six robust steps: to scan the enabling environment surrounding WSMEs, conduct WSME customer segmentation and market analysis, assess the demand among WSMEs for financial and non-financial services, design financial and non-financial products and services, and quantify the market opportunity and business case.

ACCESS THE REPORT BELOW

Developing a Global Segmentation Framework and Toolkit for Women-Led/Owned SMEs.

Facilitating greater capital flow to women-led businesses is crucial for fostering economic growth and empowerment. Despite increasing awareness of the gaps women SMEs (WSMEs) face in access to capital and banking, the supply-side response has not been intentional in targeting segments of WSMEs with unique products and services and altering their processes to serve them better. While the social and economic benefits are clear, policy and private sector priorities have not consistently aligned around supporting WSMEs in an effective manner. ConsumerCentriX, with the support of the Women Entrepreneurs Finance Initiative (We-Fi), Argidius Foundation, and the Dutch Good Growth Fund (Triple Jump), is developing a WSME Segmentation Framework and Toolkit to address this gap. The framework and toolkit aim to transform how financial sector stakeholders understand and serve women entrepreneurs and business owners.

Current market segmentation practices for WSMEs are largely supply-driven, focusing primarily on business size and gender split. This narrow approach of segmenting SME markets by business size and overlaying a definition of women enterprises fails to address the critical dimensions that define her and her business. Financial sector stakeholders need a nuanced segmentation to tailor their support and services in a way that effectively supports different profiles of WSMEs to grow.

Based on primary findings from literature reviews and stakeholder interviews conducted in phase one of the project, it became evident that existing frameworks are insufficient at addressing the unique circumstances of women SMEs. While some frameworks include personal and psychological dimensions, none offer a comprehensive view that provides for critical factors like household responsibilities and dependents. This highlighted the need for a new, holistic approach that considers the full spectrum of influences on women entrepreneurs, including the environment in which she operate and how supportive or restrictive elements like social and gender norms and legislation are.

The WSME Segmentation Framework and Toolkit developed through this project leverages a gender-inclusive approach to segmenting WSMEs: by beginning with her as an entrepreneur or business owner, separating her from her business, and placing her and her business in the environment where she operates. These factors determine the growth path that her business is on, whether low/no growth, steady growth, or high growth/venture.

Through quantitative and qualitative research with WSMEs in Pakistan, Uganda, and Colombia, CCX will be able to determine which factors about her as a person, her business and the enabling environment are deemed the strongest determinants of which growth path she ends up on. From there, CCX will define segments and profiles using the factors. Marrying that insight with learnings from research on the supply-side, the final Global Segmentation Framework will illustrate not only the descriptors/dynamics and financial/non-financial needs per segment but also the supply-side response to target each segment and where the gaps are.

Ultimately, the goal of the WSME Global Segmentation Framework and Toolkit is to provide financial sector stakeholders with the tools and insights needed to offer more targeted and practical support to women entrepreneurs.

Strategies for Financial Service Providers to Access Colombia's Untapped MSME Market

Author: Laura Trueba, Head of Latin America and the Caribbean

Co-author: Musa Kacheche, Corporate Communications Lead

Date: June 28th, 2024

Area Covered: Latin America and the Caribbean

Topics:

MSME Banking • Financial Inclusion • MSME Research • Market Segmentation

The Current State of MSME Banking

Micro, small, and medium-sized enterprises (MSMEs) are crucial to the economic fabric of Latin America and the Caribbean. In Colombia, they account for 99% of companies, 80% of private employment, and 35% of GDP. Despite their significance, MSMEs in Colombia remain underserved. They receive only 14% of total commercial loans, facing a financing gap estimated at $56.2 billion—19% of the 2017 GDP—for formal MSMEs alone. Informal companies face an additional financing gap of 10% of GDP, while women-owned MSMEs experience a shortfall of $6.1 billion.

Addressing this gap requires continued efforts by the government and financial institutions to develop innovative solutions that meet the unique needs of MSMEs in the Colombian market. With funding from the Argidius Foundation, ConsumerCentriX conducted a market feasibility study to identify barriers to access finance for MSMEs in Colombia. The study involved customer research engaging business owners in Bogota and Medellin and a market analysis involving interviews with key industry stakeholders, such as financial service providers (FSPs), government institutions and other MSME ecosystem partners.

Understanding Customer Perspectives

Despite a dynamic MSME sector with over 5.7 million enterprises, Colombia’s 1.4 million registered micro-enterprises face a vast gap in accessing financial services. These businesses often rely on retail banking solutions rather than tailored business products. For instance, they often opt for personal loans over business loans due to stricter requirements, lengthy approval processes, and high fees associated with the latter. While personal loans are more accessible, they often come with higher interest rates and rigid repayment terms, which do not align with the financial needs of the businesses. Additionally, most entrepreneurs are unaware of the offerings from the largest banks, and those familiar with them find the products unsuitable. Colombia’s registered microenterprises tend to be “multi-banked,” meaning they use financial services from different institutions, seeking the most favorable options. For example, they may take out personal loans, open deposit accounts, or access business credit from various banks. As a result, these businesses do not depend on comprehensive solutions from a single FSP but diversify their services across multiple providers.

Moreover, MSMEs in Colombia value having a dedicated point of contact at their bank, such as a relationship manager who understands their business and can offer personalized advice. The availability of knowledgeable financial advisors or loan officers helps MSMEs make complex financial decisions and grow their businesses. Furthermore, MSME owners expressed a need for non-financial services, such as business training and access to networks, to support their growth. Many business owners whose educational backgrounds may not prepare them for a growing business seek opportunities to develop essential skills and knowledge. Colombia has a diverse ecosystem of MSME support institutions, but the fragmented landscape makes it difficult for business owners to know where to access these resources.

Understanding the Competitor Landscape

Market analysis reveals intense competition in the small and medium enterprises (SME) banking sector, where major banks offer tailored and holistic market solutions. A similar level of competition exists among microfinance institutions serving the unregistered micro-enterprises. However, a significant opportunity exists within the registered micro-enterprises segment, which remains largely underserved by financial service providers.

Despite the evident need for financing among registered micro-enterprises, banks remain cautious due to perceived credit risks. Most financial institutions prefer lending to well-organized SMEs, focusing on legal entities and secured loans backed by government programs like the National Guarantee Fund (FNG), mortgages, or leasing programs. For microfinance institutions, the challenge is adapting their models—both in terms of human resources and product portfolios—to meet the needs of formal businesses. Offering lower-cost financing and overcoming the challenge of building brand recognition are additional obstacles in this space.

To differentiate themselves, FSPs should offer financing solutions that help registered micro-businesses achieve short- and long-term goals, such as purchasing machinery, expanding locations, acquiring raw materials, or maintaining cash flow with suppliers. These businesses expect low interest rates, simple requirements, fast approval, and transparent information. They also desire flexible repayment options and personal guidance from advisors who can explain the products and recommend the best options.

In conclusion, Colombia’s financial service sector holds significant potential for serving the registered micro-enterprise segment. By partnering with business development service providers and other key ecosystem players to bridge the skills gap, FSPs can position themselves as critical enablers of the growth and development of this segment in Colombia.

Empowering Women Entrepreneurs in Sub-Saharan Africa through the Africa Women Rising Initiative

Author:

Benedikt Wahler, partner

Date:

June 26th, 2024

Area Covered:

Africa, Sub-Saharan Africa

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

For the last four years, ConsumerCentriX, in collaboration with the International Project Consult (IPC) and the African Management Institute, has supported the implementation of the Africa Women Rising Initiative (AWRI), funded by the European Investment Bank (EIB). In mid-June, Benedikt Wahler and Dörte Weidig, partners at ConsumerCentriX and IPC, respectively, delivered a “Knowledge Lab” session in Luxembourg to the EIB community to share the large-scale impacts and lessons from this work.

This initiative aims to empower women economically in Sub-Saharan Africa by increasing their access to finance and capacity-building resources, particularly for women entrepreneurs, owners, and leaders in micro, small, and medium enterprises (MSMEs), in alignment with the 2X Challenge criteria.

AWRI Pilots and Builds a Foundation for Mobilizing Large-Scale Gender Finance

As part of the broader “SheInvest” initiative, through which the EIB is mobilizing EUR 2 billion of funding for gender-responsive investments in Africa, AWRI was launched in April 2020. This occurred just as Africa was experiencing the first wave of the COVID-19 pandemic to complement these funds with technical assistance (TA) from the consortium partners.

From the ConsumerCentriX team and our professional network, we contributed the Team Lead, interim team lead, and several senior experts on key factors for the success of gender-inclusive finance: unsecured and cashflow-based lending, market research, strategy and value proposition design, as well as facilitating the work of cross-functional teams to pilot new approaches. Our data team also helped ensure the recommendations reflected a sound basis of analysis and insights.

ConsumerCentriX Managing Director Benedikt Wahler, who stepped up from key expert to interim Team Lead during a medical leave, feels that “AWRI really showed once more the full breadth of expertise we were able to mobilize and the deep bench of colleagues to make one more multi-year, multi-country, and multi-institution TA a success.” It was another instance of a close and successful collaboration with IPC, alongside current joint activities on “Youth-in-Business” and the upcoming Central Asia WE Finance Code.

Thanks to AWRI, nine financial intermediaries (FIs) across four countries – Uganda, Rwanda, Senegal, and Côte d’Ivoire – received customized assistance based on a thorough assessment of their needs, the realities of their clients, and their local market context. In addition to four commercial banks (Bank of Kigali, Ecobank Group, Housing Finance Bank, Atlantic Business International), four microfinance institutions (Pride Microfinance, Centenary Bank, Baobab Senegal, Baobab Côte d’Ivoire), and one development bank (Development Bank of Rwanda) were supported on gender finance.

Before this work started, ConsumerCentriX pioneered a data-driven approach to identifying the right countries for gender finance interventions like AWRI. Using a proprietary benchmarking tool that considers four main dimensions of women’s economic, social, and financial inclusion, we screened and scored 45 economies in Sub-Saharan Africa.

The implementation focused on two main components: “Banking on Change” and “Market Maker.” “Banking on Change” targeted the supply side by enhancing the capability of financial institutions to meet the needs of women entrepreneurs with gender-intelligent products and services, while “Market Maker” focused on the demand side, strengthening women entrepreneurs’ financial and business skills and their networks.

Through the Market Maker initiative, AWRI significantly enhanced women entrepreneurs’ financial literacy and business management skills. Training programs reached 1,087 women, covering essential topics such as financial literacy, record-keeping, customer service, and soft skills. Forty per cent of the participating businesswomen subsequently obtained loans. This initiative also developed 11 non-financial services (NFS) modules tailored to the needs of women entrepreneurs, further supporting their business growth and sustainability. The impact of these efforts was evident, with many women reporting improved business practices and enhanced financial management skills.

The AWRI’s Banking on Change component focused on strengthening the capabilities of partner financial institutions (PFIs) to better serve women entrepreneurs. This included conducting comprehensive institutional diagnostics and capacity needs assessments, followed by tailored technical assistance packages delivered by a team of international and local experts. At two institutions, unsecured loan products and the respective credit processes were developed for the first time. Two others deployed their first-ever savings products tailored to businesswomen, leading to strong growth in their funding base.

Even though most improved solutions were still in the early stages of roll-out, the results were strongly positive. The number and volume of loans grew faster for women than men at all institutions. The portfolios now include 35,400 more women borrowers and EUR 67 million. Compared to the pre-AWRI baseline, our team helped advance the frontiers of inclusion: 16,000 women borrowers who otherwise would not have been expected to receive loans and EUR 40 million in loan volume. All of this was achieved while not merely preserving but even expanding the better repayment performance of women borrowers.

Why Gender Finance is the Right Approach for Impact and Commercial Success

The 2X Collaborative, of which EIB is a founding member, documents the growing momentum among the community of development finance institutions and related stakeholders that a dedicated focus on women (also known as a Gender Lens) delivers better impact. The evidence collected over the past decade by programs like the IFC’s “Banking on Women” or the Financial Alliance for Women from pioneering banks, MFIs, and fintechs around the world makes it clear that there is also a strong strategic and business case for targeting women and women SMEs as clients. At ConsumerCentriX, this reality and our expertise on what that should mean in practice drive around two-thirds of our work.

For those who care about impact, the case for being intentional in focusing on women should be straightforward: though women and men are diverse among themselves, on the criteria that matter for their ability to access and use conventional financial services, women score lower on average.

In the regional context of AWRI in Sub-Saharan Africa, women entrepreneurs face numerous challenges in operating and growing their businesses: less revenue and often smaller businesses in low-margin sectors, lower levels of secondary education and less professional experience in the formal sector, less likely to have mentors, and more limited access to capacity building, supportive networks, and market information. They are also often far less able to post the kind of assets required as collateral to obtain loans.

To truly deliver on the ambition of building an inclusive financial system that can power sustainable and broad-based economic growth, solutions ought to be benchmarked against the realities of such women – in other words, be “gender-intelligent.” To genuinely aim for reaching the marginalized parts among women and other groups, those experiencing the highest levels of such challenges should set the tone, thereby aiming for solutions that stand a chance of being “gender-transformative,” i.e., over time, wearing down these challenges rather than just working around them. The reality of supposedly fair “gender-neutral” approaches is that they are bound to fall short of most women and even a good portion of male users of financial services. They are designed for a type of client who is just not representative of the population at large – let alone those at the frontier of the financial system. (see charts below)

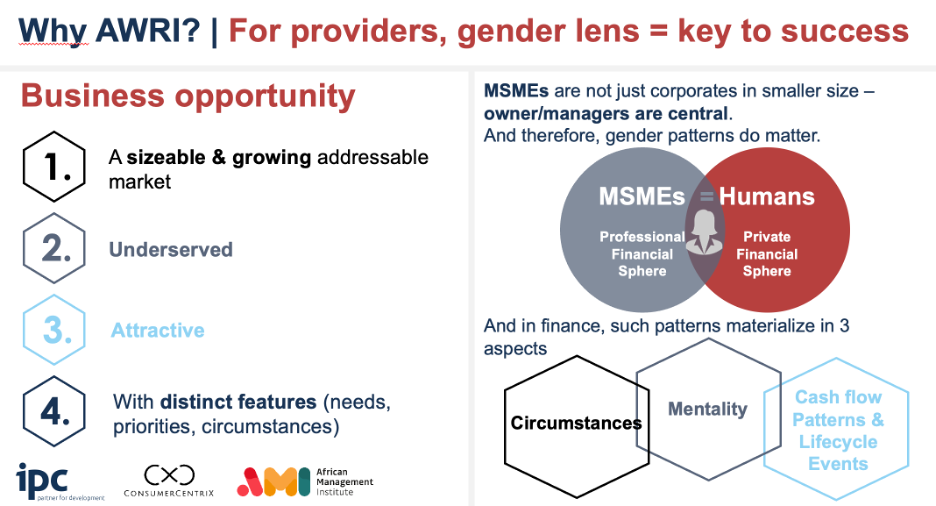

In the AWRI program – as in most of our work – we were tasked with working with for-profit financial service providers. There is now a strong basis of evidence that women and women’s businesses constitute a clear business opportunity. But business bankers tend to ask why they’d need to become “gender-intelligent” in their work. Is not a business and a leasing contract a leasing contract, whoever sits on the client side of the relationship?

For the ConsumerCentriX team, the answer is clear: to actually seize that opportunity, bank executives do well to look closer and remind themselves that what sets MSMEs apart is not that they’re smaller than big firms. It’s the human(s) at the heart of these businesses. The owners and managers whose ambitions, outlook, and idiosyncrasies shape what the business will end up doing – and this is why gender patterns matter. In the space of finance, such patterns emerge 1) from the legal, family, and socio-cultural circumstances in which women have to operate, 2) the mentality and attitudes they bring to financial questions, and 3) the way in which their cashflows are (much more strongly) exposed to lifecycle events like marriage, childbirth, divorce, or care for elderly parents. (see below)

Notably, the success stories featured at events like the Financial Alliance for Women’s Annual Summit come from institutions that have taken such insights into action. This year’s edition in London included two Champions, Access Bank Group from Nigeria and Kenya Commercial Bank, who referred to business banking solutions that emerged from their work with our own Anna Gincherman and Benedikt Wahler.

As Benedikt summed it up: “With the now concluded AWRI program, our team is proud to have laid excellent foundations for seeing more such pioneering examples scale up in Africa.”

Implementation of Women Entrepreneurs Finance Code in the Dominican Republic.

In the Dominican Republic, micro, small, and medium-sized enterprises (MSMEs) play a significant role in economic growth and employment rates, comprising 99% of all businesses and generating over half of the country’s jobs. Despite this, MSMEs face disparities in accessing financial services and resources. In particular, female-owned micro, small, and medium-sized enterprises (WMSMEs) struggle to access the needed services.

To address this, The Superintendent of Banks (SBDR) has mandated Financial Service Providers (FSPs) to collect and report sex-disaggregated data for individuals and commercial businesses. SBDR has partnered with other public institutions to align on the segmentation of businesses and, as a result, published the country’s first MSME dashboard in 2024, allowing them to enhance their understanding of credit offered to different MSME segments and identify gender gaps in access. However, challenges persist in collecting quality data and a standardized definition of WMSMEs. Findings from the IDB Invest and ConsumerCentriX Study revealed that 62% of banks collect sex-disaggregated, with 50% registering WSME data for their product offerings, indicating a need for further improvement in data collection practices.

Recognizing the necessity to address these challenges, IDB Invest, the private sector window of the Inter-American Development Bank Group, recruited ConsumerCentriX and the Financial Alliance for Women (FAFW) for the implementation of the Women Entrepreneurs Finance Code in the Dominican Republic. This pilot is private-sector led, which means that through key private sector partners, including the Banking Association and key FSPs, the project has the aim of reaching an industry-wide capacity to both disaggregate data by sex, and improve financial services for women entrepreneurs.

The WE Finance Code or the Code is a commitment by FSPs, regulators, and other financial ecosystem stakeholders to work together to increase funding and support to women-led micro, small, and medium entrepreneurs. The project is a timely initiative since the Code has already gained much-needed momentum following its successful launch at the FAFW Summit in November 2023, where key stakeholders in the country’s financial sector, including regulators, associations and FSPs, committed to the Code by signing the letter of intent.

The project involves building the capacity of the national coalition consisting of the local aggregator and coordinator of the Code, Bankers Association “Asociación de Bancos Múltiples de la República Dominicana” (ABA) and FSPs to execute the Code commitments. This will be achieved by supporting ABA in aggregating, analyzing, and visualizing the collected WMSME data, as well as supporting FSPs in collecting quality data on WMMSEs and using it to develop holistic propositions tailored to addressing the needs of women entrepreneurs.

The initial signatories to the Code include multiple banks such as BHD, Popular, Banreservas, Caribe, Scotiabank, Banesco, JMMB Bank, LAFISE, Promerica, Santa Cruz, Vimenca, and ADEMI, along with savings and credit banks like ADOPEM and Confisa. Also participating from the government sector in this initiative are the Central Bank, the Superintendency of Banks, and the Ministry of Industry, Commerce, and MSMEs. These entities play significant roles in the crucial aspects of the project’s execution and regulation.

The Code in the Dominican Republic is a pioneering initiative at the regional level that will establish guidelines for implementation in other countries on the continent. The project seeks to position the Dominican Republic as a model for other countries by documenting best practices through case studies and creating tools for other nations to learn from and develop their Codes.

How has Covid-19 affected the Stanbic Business Incubator and How Does it Plan to Respond? Chief Executive Tony Otoa Explains

ConsumerCentriX works closely with Stanbic Bank Uganda on both the COVID-19 Business Info Hub and the Stanbic Business Incubator. This article originally appeared on the COVID-19 Business Info Hub.

How has Covid-19 affected the Stanbic Business Incubator and How Does it Plan to Respond? Chief Executive Tony Otoa Explains

Like all businesses, the Stanbic Business Incubator (SBIL) faced a slate of new challenges and obstacles stemming from the pandemic. To understand how the Stanbic Business Incubator navigated these challenges, we sat down with Tony Otoa, SBIL’s Chief Executive. Mr. Otoa provided us with an insider’s perspective on SBIL’s pandemic experience, lessons learned, and projections for Covid-19 recovery.

Mr. Otoa explained that the pandemic afforded SBIL one major lesson: a business must remain agile and adapt to the flow of the new normal. Covid-19 upended traditional business operations, relationships, and practices. Businesses that were unable to adjust and respond to the evolving environment suffered immensely while those that were flexible and adapted practices and operations as things changed flourished. For its part, the Stanbic Business Incubator changed its program development process and how it connects with its clients.

Because of the lockdown, explained Mr. Otoa, SBIL was unable to carry out in-person training, so the team switched to online platforms to complete its mandate of supporting Uganda’s business community. Like in businesses throughout the world, transitioning online heavily impacted how SBIL delivers its services and required a shift in its approach to client relations and communications. The upshot to these challenges was an increase in the number and geographic location of people reached. Pre-pandemic, class sizes were limited to what was allowed by regional training hubs, but the online platforms allowed SBIL to reach many people through the country.

Mr. Otoa believes that SBIL’s Covid-19 recovery started long before the lockdowns were lifted. Stanbic Business Incubator remains focused on supporting businesses to drive and achieve more. Their strategy is to assist businesses in accessing finance, accessing markets, and provide tracking to better understand how to support them better. More importantly, is how this support is delivered. Mr. Otoa stresses the need to blend approaches to best support businesses in the coming period. This means combining online and in-person training to best support their clients while blending business techniques from both the pre- and post-Covid period.

SBIL expects its new chapter to encapsulate the lessons learned from this pandemic period. Namely, the need for agility as they switched to new, online platforms, the new geographic regions and audiences they were able to reach as a result of their online shift and continuing the newly blended approach to continue supporting their clients. All told, Stanbic Business Incubator expects a strong recovery for themselves and for their clients as they step forward into this new period.

Interested in training opportunities with the Stanbic Business Incubator? Incubator Business Manager Sheila Agaba explains upcoming offerings

ConsumerCentriX works closely with Stanbic Bank Uganda on both the COVID-19 Business Info Hub and the Stanbic Business Incubator. This article originally appeared on the COVID-19 Business Info Hub.

Interested in training opportunities with the Stanbic Business Incubator? Incubator Business Manager Sheila Agaba explains upcoming offerings

- Sheila Agaba

Business Manager, Stanbic Business Incubator

The Covid-19 Business Info Hub recently sat down with Sheila Agaba, the Stanbic Business Incubator’s Business Manager to discuss the many training opportunities on offer to small and medium enterprises and aspiring entrepreneurs.

Ms. Agaba leads Stanbic Business Incubator Limited (SBIL)’s strategy, coordinates partnerships, and tracks SBIL’s impact. During her tenure, she has witnessed some of the pandemic’s major impacts on SBIL’s clients. She notes that small- and medium-sized enterprises (SMEs) struggled throughout the pandemic to access much-needed finance. Viewed as riskier investments by financial institutions, SMEs struggle to secure capital to develop their businesses. To address this challenge, SBIL has implemented various capacity-building trainings to help de-risk SMEs and improve their chances for access to credit.

The Enterprise Development Programs – which have been rebranded as the Stanbic Accelerator Program, Micro enterprise Development Program and Supplier Development Program. These will have both in-person and online sessions and include both a local and regional focus. These sessions specifically target SMEs at a more intermediate stage of their business journey, such as those that can provide annual turnover reports and other business information. The local program largely supports businesses with the know-how to access capital and markets in the Kampala region. They were shifted fully online when Covid-19 struck for safety reasons. The Micro Enterprise Development Program provides similar support but operates at a national level and targets micro enterprises with 1-2 staff and an average annual turnover of 5M shillings.

SBIL’s Supplier Development Program is largely geared toward those in the oil and gas industry. This program supports SMEs aiming to qualify as suppliers to larger companies engaged in drilling and other work across the Albertine region. The program supports SMEs to get registered to the national supplier database if not yet registered. This program will support linkages for the beneficiaries to the existing players in the oil camps in order for them to supply companies in drilling and oil and gas construction. This will be conducted with support from local oil companies in the industry. In addition, personal finance modules help SMEs with the necessary principals to arrange both personal and business financing. Similarly, SBIL arranges masterclasses post the trainings for alumni which are information-sharing sessions for about several topics relevant to business growth.

SBIL’s program Implementation relies on financial support from Stanbic Bank, local and international partners This funding helps SBIL to deliver on the key pillars of access to capital and market for SMEs. These programs facilitate SMEs develop new product lines, obtain new contracts, and expand into new markets and geographical regions. One of SBIL’s major partners is the German Agency for International Cooperation (GIZ), which focuses on job creation specifically for women and youth. Their target is to create employment for nine hundred people annually through the GIZ partnership. The French Embassy in Uganda is another donor that focuses on supporting SMEs especially youth and women in agroecology and ecotourism. Similarly, the African Development Bank (AfDB) has partnered with SBIL through Petroleum Authority Uganda (PAU) to facilitate and train Business Development Services (BDS) to over 200 SMEs in various sectors along the EACOP route districts – a Ugandan area where the oil and gas pipeline will pass before entering Tanzania. All told, these partnerships have yielded a significant increase in SMEs’ access to funding. 27% of unbanked SMEs engaged in the programs have opened accounts with Stanbic Bank while 15% have begun access credit from Stanbic Bank. 35% have improved their tax compliance – allowing access to more markets and proving an early victory for SBIL’s international partners.

With pandemic lockdowns coming to an end, Stanbic Business Incubator is now looking to the future and how it can keep serving the business community. Ms. Agaba notes that the company is looking forward to expanding partnership opportunities while prioritizing sustainability.

Meet three incredible women entrepreneurs as we celebrate women this March.

This video was originally posted on the SME Response Clinic

Meet three incredible women entrepreneurs as we celebrate women this March.

This March, join us as we reflect on and celebrate the vital role women play in our communities and the tremendous contribution they make to our economy. The SME Response Clinic spoke to three women entrepreneurs to understand what women’s month means to them s, what motivated them to start their own businesses, and get their advice for aspiring women entrepreneurs.

Here is what they had to say!

Business Training During the Pandemic: Experiences, Lessons and Recommendations from the Stanbic Business Incubator Limited

ConsumerCentriX works closely with Stanbic Bank Uganda on both the COVID-19 Business Info Hub and the Stanbic Business Incubator. This article originally appeared on the COVID-19 Business Info Hub.

As the pandemic enters its third year, governments and the private sector reflect on the lessons learned from COVID-19. The last two years have yielded extensive data on how external shocks and crisis response can affect the business community.

Stanbic Business Incubator Limited (SBIL) has played a key role in supporting small- and medium-sized enterprises (SMEs) in Uganda, guiding many businesses through the pandemic’s perpetual twists and turns while helping them to make sense of the information overflow. To benefit from these lessons, the COVID-19 Business Info Hub will highlight SBIL’s experience throughout the pandemic in an effort to benefit the Ugandan business community.

Founded in 2018 and operating under Stanbic Uganda Holdings Limited, the Stanbic Business Incubator Limited runs capacity building and entrepreneurship development programs for SMEs. In 2021 alone, SBIL managed to train over 700 business owners from various sectors and more than 4500 entrepreneurs across Uganda. Drawing from SBIL’s experience in training SMEs through the pandemic, this series will focus on the experience of the Incubator’s experts and training staff through interviews and first-hand discussions. Our readers can expect insight into different topics, including:

- A high-level overview of SBIL’s impact, responses, and opportunities for SMEs as they navigate the pandemic

- An exploration of SBIL’s partnerships and upcoming programs helps to outline what it prioritizes for members of the business development workshop.

- Reflecting on 2021’s selection of training programs, Incubator staff discuss the experience of the program’s exiting alumni so businesses can learn from their peers

- First-hand interviews with alumni and non-members help to better understand SMEs biggest needs while sharing frontline experience as they navigate the pandemic

Over the next five articles, we’ll help SMEs understand the unfolding business environment with experience from SBIL’s practitioners, managers and businessowners. Readers are likely to find business insights that will help in developing new strategies and tactics to maintain their business competitiveness while responding to the fast-changing conditions of an evolving pandemic.

Interested businessowners may be interested in SBIL’s upcoming schedule of master classes, training events, cohorts and partnership events. Similarly, readers may be interested in the Compassionate Leadership Webinar Series, which provides training through a slate of webinars. Updates on all these programs and more will be available on the COVID-19 Business Info Hub.

Ultimately, the coming series of articles provides opportunity for businesses to benefit from peer-learning and the guidance of an industry stalwart. We look forward to you joining us.

SME Response Clinic hosts webinar on Practical Solutions for Improving the Wellbeing of Women Entrepreneurs

A version of this article was originally posted on the SME Response Clinic

The SME Response Clinic held a webinar on practical solutions for improving the wellbeing of women entrepreneurs at Kigali Public Library on the 8th of December 2021. The webinar was part of the Building Back Healthier Series that was launched with a talk show on KT Radio on the 18thof October 2021 and followed another webcast on practical strategies to deal with stress held in November. The series is organized in partnership with the Geruka Healing Centre.

The objective of the webinar was to inform, inspire, and share knowledge and skills that businesswomen can use to better their wellbeing when dealing with day-to-day stresses of running a business while managing other responsibilities. In addition, the webinar dove into practical techniques for increasing psychological safety and productivity and how to optimize the workplace especially for women entrepreneurs.

The webinar featured a mental health expert, Adelite Mukamana, M.Sc., with two active businesswomen, Scovia Umutoni and Amina Umhoza. Mme. Mukamana started the session with a fantastic example to help the audience have an in-depth appreciation of mental health and wellbeing:

Our mind is like an engine of any car. No matter how good-looking the car might seem on the outside, without the engine, it wouldn’t start. The car can only move when the engine is working in full force. Think about your mental health and wellbeing like that. When something is wrong with your car engine, you look for a mechanic. The moment you feel that your mental health or wellbeing is struggling, look for professional help.”

Our mind is like an engine of any car. No matter how good-looking the car might seem on the outside, without the engine, it wouldn’t start. The car can only move when the engine is working in full force. Think about your mental health and wellbeing like that. When something is wrong with your car engine, you look for a mechanic. The moment you feel that your mental health or wellbeing is struggling, look for professional help.”

Scovia’s Experience:

Scovia’s Experience:

Scovia Umutoni is Founder of KGL Flour Limited, an agribusiness factory that produces maize flour – locally known as Kawunga – and animal feed. Before the pandemic, she was employed elsewhere, but she lost her job like many others when the pandemic hit. Undeterred, she decided to invest her savings to create her own business.

While exciting, it proved to be a very challenging time because once she started her business operations, Rwanda went into lockdown, putting everything on hold.

By the time lockdown was over, while many businesses were back up and running, Scovia’s target market including schools and hotels were still not operational. She started to feel frustrated and uncertain about the future. Scovia thought quickly and decided to change her approach, targeting the Democratic Republic of Congo (DRC). She has been serving customers in DRC since then, and as Rwanda has begun to recover, she has started to deliver her products locally.

Scovia believes that women entrepreneurs often face specific challenges based on the fact they are women. When she ordered a corn flour machine to start her business from a local businessman, Scovia struggled to get the machine in the agreed-upon two week period. It took engaging male friends to visit the provider with her for Scovia to get the machine two weeks later than promised. Scovia is certain that had she been a male entrepreneur, she would not have had to resort to engaging friends to help her. This is just one example of common obstacles faced by women entrepreneurs, many of whom were also disproportionately affected by COVID-19.

During the pandemic, Scovia took a step back to reflect on her businesses and to think of new strategies to improve operations. Recognizing the importance of her own wellbeing, she took a number of actions to improve her mental health, including listening to music. Her business life is not without challenges – she still faces challenges like being a woman in a male-dominated industry and travel restrictions due to the ongoing pandemic – but she doesn’t intend to stop. Scovia has learned that challenges will always exist, and what is important is to look for solutions to deal with them.

Amina’s Experience:

Amina’s Experience:

Amina Umuhoza is Founder and CEO of SAYE – DUKATAZE LTD, which aims to fight unintended pregnancies in young Rwandan women due to menstruation stigma. Her company provides young women with reproductive health information, menstrual hygiene management, and economic empowerment by selling products produced by young women through technology and community engagement.

The COVID-19 pandemic dramatically changed SAYE’s operations, and like many other businesses, the company took its business online during lockdowns. This major shift in operations led Amina and her colleagues to question whether they would attain their goals, and Amina had to work hard to balance competing priorities. For instance, the company had to use profits planned for investment to instead pay employee salaries to ensure proper staffing and employee satisfaction. Choices like these have allowed Amina to ensure SAYE continues delivering on its business and social objectives throughout the challenges of the pandemic.

Like Scovia, Amina also faces challenges unique to being a woman entrepreneur. A key example is negative comments from others, including social media bullying. It is not uncommon for Amina to receive questions about plans to marry when she posts about new products or partnerships. She believes that these comments come from cultural beliefs about the role of women, but things have started to change as the government has been educating Rwandans on the role of a woman in societal, family, and personal development.

The hardest part of responding to the COVID-19 pandemic for Amina was to ensure she was strong and resilient for herself as well as for her co-workers and employees. Amina used the lockdown as productively as possible to ensure a positive mindset, reflecting on herself and catching up on important paperwork. This cheered her up, and that feeling encouraged her to reach out to co-workers through virtual platforms. Amina also managed to take care of action items she had postponed or put off pre-pandemic, which provided SAYE with new opportunities after lockdown.

Building Back Healthier:

Scovia and Amina seek to thrive as businesswomen, but this is not always easy. Both receive negative comments based on stereotypes nearly every day; for example, the idea that as women entrepreneurs they can only be successful if they are married. Adelite Mukamana disagrees with this stereotype. “We often hear that the development of women depends on a man. Scovia and Amina are true examples that a businesswoman can run her business smoothly and shine through all circumstances, and we hope they are good examples to our fellow women in the Rwandan society,” she says.

Both entrepreneurs agreed on one fact – one chooses her or his own mentality, and a positive sense of wellbeing is key to carrying on in the face of adversity. Adelite Mukamana agrees. “We act how we think, and we decide how to think,” she says.

Women entrepreneurs are typically challenged by balancing work and home life. Amina believes that marrying to a partner who supports you and who understands your vision is a crucial element for a success as a businesswoman. Mme Adelite Mukamana, both an expert in her field and a mother, advised businesswomen to not be afraid of having families since a woman is a human being that is capable of carrying out multiple tasks. She advised women to launch businesses regardless of their family lives if they’re confident they can do it. She also pointed out that men shouldn’t be threatened by women’s economic empowerment and their partners’ success but instead focus on growing together.

Visit the SME Response Clinic for tips for entrepreneurs to support their mental health and wellbeing. We also invite you to keep an eye on our social media platforms for entrepreneurs’ stories on how their businesses are prioritizing mental health and wellbeing, as part of responding to the COVID-19 pandemic challenges. You can find us on YouTube,Facebook, Twitter, and LinkedIn. Submission