Examining Key Financial Inclusion Barriers in the LAC Region through ConsumerCentriX's Ecosystem-Centric Engagements

Author:

Laura Trueba, Head of Latin America and the Caribbean

Date:

June 28th, 2024

Area Covered:

Latin America and the Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Gender-Inclusive Finance• Financial Regulation • Digital Financial Services

In the past two years, ConsumerCentriX (CCX) has undertaken important projects aimed at addressing barriers to financial inclusion in the Latin America and Caribbean (LAC) region. Drawing upon years of experience and more recent engagements, which included collaboration with Multilateral Development Banks (MDB), regulators and financial service providers (FSPs), CCX has an ecosystem-centric understanding of the financial inclusion landscape in the region. This approach has allowed us to identify and address the major challenges hindering greater financial inclusion in the region. To shed light on these major challenges, this blog will highlight some significant barriers.

Among the interventions that have empowered CCX to gain this valuable understanding include the Supply-side Sex-disaggregated Data Survey, commissioned by IDB Invest, reaching 13 LAC countries. This survey covered over 240 financial service providers in the region to understand their strategies for the women’s market, including mapping their financial and non-financial product offerings and their use of sex-disaggregated data. This resulted in a publication, “Women Rising“, highlighting, among many other insights, the untapped revenue potential in the women’s market, ranging from $1.87 billion in Mexico to $283 million in Guatemala.

Regarding the state of financial inclusion of women micro, small and medium businesses (WMSME), CCX has been recruited by IDB Invest to support the successful implementation of the Women Entrepreneur Finance Code (We-Fi Code) in the Dominican Republic. This will involve enhancing the capacity of the Asociación de Bancos Múltiples (ABA) as the local Aggregator and Coordinator, as well as FSPs, to fulfil the commitments of the Code.

On the regulatory side, CCX collaborated with the Alliance for Financial Inclusion (AFI) to develop a Gender-Inclusive Finance (GIF) Roadmap for AFI 11 member countries in the LAC region. This initiative aimed to systematically review practical policy actions to enhance women’s financial inclusion and reduce gender gaps. CCX also worked with AFI to conduct case studies of 13 countries, including eight from the LAC region, to understand the role regulators play in closing the financial inclusion gender gap.

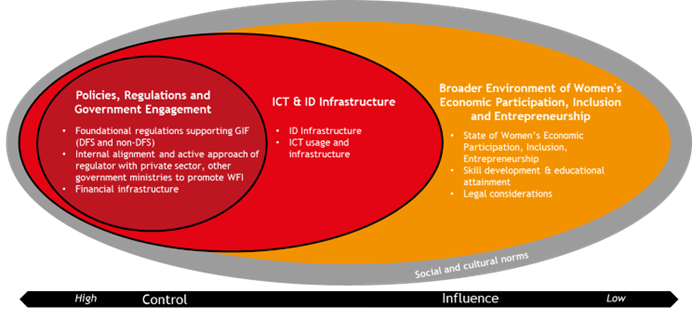

To conduct these case studies, an Analytical Framework for Inclusive Finance with a Gender Perspective was developed in partnership with AFI that comprises four key spheres that impact the state of financial inclusion in a country, such as 1) FSP’s actions towards women’s financial inclusion, 2) Policies, Regulations, and Government Engagement, 3) ICT and ID Infrastructure, and 4) the Broader Environment of Women’s Economic Participation, Inclusion, and Entrepreneurship.

Unveiling Financial Inclusion Disparities Between Rapidly Progressing and Slower Progressing Countries

- Delving into the regulatory landscape

Following our assessments and employing the AFI Framework for Inclusive Finance with a Gender Perspective as the analytical cornerstone, a significant disparity is observed between countries with limited financial inclusion and those that have made substantial progress. This disparity primarily revolves around the availability of financial infrastructure, the network of banking agents, their outreach, and utilization, which must also include mobile money/digital solutions services. Some developed regulations lack a digital financial services component, particularly concerning the interoperability of mobile banking, primarily within banking agents.

Interoperability, Open Banking, and National Financial Inclusion Policy in Perú

The Central Reserve Bank of Perú (BCRP) has been working on increasing interoperability to promote digital payments and financial technology and further drive financial inclusion. As of 2021, 44% of women and 55% of men reported making or receiving a digital payment to Global Findex, which is high for the region. To support the prevalence of digital payments, the BCRP has worked to strengthen retail interoperability, especially since the COVID-19 Pandemic. Today, over 100,000 retailers across the country are compatible with e-money. The BCRP has stated that payment providers must be interoperable, setting an implementation schedule for interoperability. The BCRP also runs the payment switch for interbank transfers, checks, ATMs, and mobile money, all integrated under the real-time gross settlement system.

Furthermore, we have observed that alongside mobile interoperability, there is a crucial need to ensure adequate regulation of mobile and digital financial services. Such regulation should permit electronic wallets for retail payments, facilitate the opening of e-wallets without mandatory linkage to a bank account, and enable digital customer identification (e-KYC) for individuals to open e-wallets or basic bank accounts remotely.

E-Wallets in El Salvador

E-wallets in El Salvador are driving financial inclusion, with uptake that is outpacing that of traditional bank accounts. In 2015, the country passed the Law to Facilitate Financial Inclusion; while the law spans many areas including tiered KYC, arguably its most important provision is the regulation of e-wallet providers and savings accounts with simplified requirements. The law imposes disclosure requirements, consumer protection standards, provides transaction limits for agent banking, and authorizes banks to issue their own mobile money services.

By paving the way for e-money and its use in the country, the law resulted in explosive growth of the MNO Millcom’s Tigo Money. Today, over 1 million Tigo Money accounts exist in El Salvador, representing about 20 percent of the adult population, which is immense compared to the 29% of women and 45% of men who own a bank account according to Findex 2021.[1]

More recently, in 2021, El Salvador’s government passed the Bitcoin Law and the roll-out of Chivo, a government-owned e-wallet for cryptocurrency and dollars. As of 2021, 3 million Salvadorians have downloaded the app and created an account, amounting to 46% of the population, 52 percent of which are women.

- Delving into the financial service provider landscape

According to the IDB Invest Supply-side Sex-disaggregated Data Research Survey, most FSPs in the region focus on the women’s market but still consider it part of their corporate social responsibility strategy. There is a clear knowledge gap on the business case and profitability of serving the women’s market, attributed to a lack of capacity to collect, use and analyze sex-disaggregated data. Moreover, without this data, FSPs are unable to develop holistic women’s market strategies, which are crucial for designing and marketing offers and products aimed at women clients.

While 75% of commercial banks in the region reported collecting sex-disaggregated data, over half (52%) continue to use manual reporting processes, which raises concerns about data quality, and most still have not established key performance indicators (KPIs). Furthermore, FSPs with advanced market strategies generally do not leverage the available data to evaluate return on investment or profitability.

As a result, they overlook clear business expansion opportunities, given their lack of emphasis on profitability as a reason for targeting the women’s market. By not thoroughly analyzing their existing data, FSPs may be missing a crucial business strategy for enhancing their focus on women.

Addressing financial inclusion barriers in the LAC region is crucial for socio-economic development. This requires collaborative efforts from regulators, FSPs, public entities, civil society organizations, and development partners. By continuing to innovate and adapt, CCX is paving the way for a more financially inclusive future.

AFI Policy Toolkit • Blog: A guide to designing Gender-Sensitive Rapid Response and Crisis Recovery Policies

Author:

Benedikt Wahler, Partner

Date:

October 10th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Crisis Response • Resilience Building • Research

Are financial inclusion and the promotion of gender equity “fair weather topics”? How should policymakers set their priorities when a fast-moving crisis fraught with uncertainty and large downside risks requires their full attention, as the COVID-19 pandemic did?

“Actually, weaving a focus on women and their financial inclusion into the design of crisis response is likely to be a force multiplier rather than a distraction”. This is how ConsumerCentriX (CCX) Partner Benedikt Wahler summarizes the team’s research on behalf of the Alliance for Financial Inclusion (AFI), a network of central banks and other financial regulatory institutions from 76 developing countries. Home to the majority of the un- and underbanked, such questions matter a lot to the welfare of these member countries.

The global pandemic confronted policymakers with large-scale and fast-moving disruption. In turn, it also provides a wealth of experiences that this assignment of CCX sought to extract and assess. Over the summer of 2023, AFI shared these in a Special Report “Closing the Financial Inclusion Gender Gap During the Crisis and Afterwards”.

These insights draw upon deep-dive research, interviews with decision-makers and stakeholders, and a survey of more than a third of AFI members facilitated by the Gender Inclusive Finance (GIF) Team at AFI led by Helen Walbey and undertaken by the CCX team as the pandemic evolved over the course of 2021 and 2022. A set of five country case studies draws attention to how large emerging markets like Egypt and small ones like Paraguay or Fiji have been able to effectively respond to this massive crisis with the focus provided by a gender lens and financial inclusion policy.

These experiences should serve as inspiration and provide policymakers with a sense of possibility. But what should executives at central banks or regulatory agencies actually be doing during the next crisis – or even now?

To help provide such guidance, AFI published the “Gender-Sensitive Rapid Response and Crisis Recovery Policies” policy toolkit – a comprehensive guide for policymakers, practitioners, and development partners on designing and implementing gender-sensitive rapid response and crisis recovery policies.

Globally, 740 million women are excluded from financial sector services, and their inclusion could add approximately USD 12 trillion to the global domestic product. This is a vast untapped market for the financial sector. Taking evidence from the experiences of AFI members as expressed in the Special Report, gender-inclusive finance policies can reverse the previously widening gender inequality or access gaps. Besides the additional economic impact, benchmarking policymaking against the realities and constraints of women can strengthen economic stability and growth through improved women’s access to formal financial services, leading to positive outcomes for families and communities. And actually, this approach ends up working better also for many men. This strength of gender-inclusive finance at the center of the policy toolkit is highlighted by what outcomes various shades of gender-inclusive financial policy are likely to deliver – as illustrated in the toolkit here.

Gender-neutral policy designs are often benchmarked by the realities of men, and as a result, they only work for a minority of relatively privileged women. They do not consider the needs and constraints of the average female. The resulting policies or financial offers do not even work well for many men. Gender-intelligent or gender-intentional solutions start by setting the average woman and her constraints as a guideline, and they stand a good chance of adequately serving a majority of women. Gender-transformational policy design explicitly explores the intersectionality of challenges faced by the minority of excluded and marginalized women, and such policy solutions may often require more fundamental interventions.

In disruptions like the COVID-19 pandemic, rapid response and crisis recovery policies that are charged by the power of gender-sensitive design are needed – the AFI Policy toolkit offers three main tools for developing these. The first toolkit explores the role of stakeholders in crisis response. Stakeholders such as donors, ministries and civil society organizations are likely to have networks related to vulnerable groups, and they can help communicate and mobilize interest for interventions in terms of crisis. The second toolkit offers a benchmarking tool for policymakers’ country’s context for gender-inclusive finance. The Excel-based tool developed by ConsumerCentriX allows policymakers to assess the context and baseline necessary for embedding crisis response, recovery and broader financial inclusion policies for AFI members and other stakeholders. The third toolkit explores gender-inclusive crisis response strategies that can be employed depending on the crisis response phase the country is on. These include:

- Fast-paced “fire fighting”

- Enabling recovery

- Building back better for resilience.

Overall, the toolkit provides a valuable resource that enables practitioners at central banks and financial sector regulators, as well as their peers at government ministries to design gender-inclusive financial policies that address barriers to financial inclusion for the majority of vulnerable segments, including women while also allowing them to collect wider sets of data and inputs for improving existing policies and putting in place strategies for future crisis response.

Learn more: AFI Policy Toolkit “Gender-Sensitive Rapid Response and Crisis Recovery Policies

The Role Regulators Play in Closing the Financial Inclusion Gender Gap

Author:

ConsumerCentriX Project Team

Date:

September 26th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Gender Equality • Covid19 • Gender Gap

Through the Financial Inclusion Gender Gap Project, ConsumerCentriX contributed to developing 13 case studies from AFI’s membership countries to provide a deeper understanding of women’s financial inclusion status in each, along with key barriers and enablers.

The case studies are one of the key project deliverables designed to help national financial regulators and policymakers identify highly specific and concrete actions to advance gender-inclusive finance in AFI’s member countries.

Learn more from CCX-supported case studies published for the project:

SOLOMON ISLANDS CASE STUDY

Most Solomon Islanders transact in cash and women especially prefer to save at home, with 53 percent of women reporting that they save in a “secret place at home”. For the past decade, the Solomon Islands government and the Central Bank of Solomon Islands have prioritized financially including the unbanked, specifically identifying women, rural individuals, and informal workers as target groups.

© 2023 (August), Alliance for Financial Inclusion. All rights reserved.

HONDURAS CASE STUDY

By 2017, the country had achieved a 2.7 times growth in women’s account ownership and 41 percent of women owned a bank account. However, vast swaths of women remain unbanked or underserved by financial services, many of them being unemployed or lower-income working in the informal economy. This case study offers an overview of the current state of women’s financial inclusion in Honduras.

© 2023 (April), Alliance for Financial Inclusion. All rights reserved.

GHANA CASE STUDY

The improvement can be credited to the financial regulators’ significant investment in digital financial services and mobile banking. Although Ghanaian women are eager to use digital services, they are still marginalized by the formal financial system, and lack tailored products that fit their specific financial and business needs.

© 2023 (May), Alliance for Financial Inclusion. All rights reserved.

UGANDA CASE STUDY

Outside that realm, women still utilize informal financial services like village savings and loan associations and rotating savings and credit associations. There is an opportunity for improved coordination and collaboration of the ecosystem players under the new national financial inclusion strategy and an explicit focus on women’s access and usage.

© 2023 (May), Alliance for Financial Inclusion. All rights reserved.

MEXICO CASE STUDY

As the second-largest economy and population in Latin America, Mexico has the resources and institutions to tackle gender financial inclusion thanks to its national financial inclusion approach. Mexico’s Central Bank, Comisión Nacional Bancaria y de Valores has implemented several regulations and initiatives to create an enabling environment for women’s financial inclusion through both digital and non-digital services.

© 2023 (August), Alliance for Financial Inclusion. All rights reserved.

EGYPT CASE STUDY

The Central Bank of Egypt (CBE) led several initiatives that contributed to advancing women’s financial inclusion, reflecting a growth of 210 percent in women’s transaction account ownership. The Egyptian government and CBE are taking steady steps towards more gender equity, economic empowerment, and financial inclusion, in pursuit of an inclusive society.

© 2023 (June), Alliance for Financial Inclusion. All rights reserved.

PAKISTAN CASE STUDY

Pakistani women are not only severely disadvantaged in terms of education, economic opportunities, and entrepreneurship, but also restricted by the country’s conservative legal framework. These factors directly impact women’s access and use of financial services and will be essential to address to further close financial inclusion gender gaps.

© 2023 (July), Alliance for Financial Inclusion. All rights reserved.

Closing the Financial Inclusion Gender Gap During the Crisis and Afterward: Experiences and Lessons Learnt from AFI Members

Author:

ConsumerCentriX Project Team

Date:

September 26th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Gender Equality • Covid19 • Gender Gap

ConsumerCentriX supported the Alliance for Financial Inclusion (AFI) in conducting five case studies from AFI’s member countries to understand the nexus of women’s financial inclusion and crisis response under the “Closing the Financial Inclusion Gender Gap During the Crisis and Afterward” project.

The case studies share experiences and lessons that AFI’s member countries learned from their crisis response and recovery policies from the COVID-19 pandemic while focusing on gender-inclusive finance. Evidence from the case studies shows how AFI members protected and promoted women’s financial inclusion and effectively applied it as part of a crisis response during the pandemic. Lessons learnt from AFI members such as Paraguay, Egypt, Fiji, Bangladesh, and Zimbabwe indicate that focusing on gender- inclusive finance helps set the right priorities, mobilise the most impactful stakeholders, identify key operational challenges, and target beneficiaries with a significant multiplier effect. Enabled by the opportunities of digital finance that can be ramped up fast even for developing countries that have seen limited adoption, gender-inclusive finance gets crisis relief and stimulus to where it is needed most and ensures economic life can continue.

Learn more from CCX-supported case studies published for the project:

FIJI CASE STUDY

As an island nation in the Pacific Ocean, Fiji saw strong disruptions to its key economic activities caused by the COVID-19 pandemic, which disrupted travel for tourism and overseas work. Together with the challenges of climate change, Fiji understands it faces a need to revise and diversify its growth strategy for resilience.

© 2023 (May), Alliance for Financial Inclusion. All rights reserved.

BANGLADESH CASE STUDY

From being one of the poorest nations at the time of its independence, Bangladesh has advanced its human and economic development. Being one of the most populous countries, this success and its ability to contain the pandemic’s disruptions matter particularly. Increasing women’s financial inclusion can be the key to unlocking better performance.

© 2023 (March), Alliance for Financial Inclusion. All rights reserved.

EGYPT CASE STUDY

Strongly affected by the COVID-19 Pandemic, Egypt has been able to implement economic recovery measures, ease restrictions, and rebound in important economic sectors, such as agriculture, tourism, manufacturing, and communications.

© 2023 (June), Alliance for Financial Inclusion. All rights reserved.

PARAGUAY CASE STUDY

The World Bank considered it as one of the South American countries best positioned to cope with the COVID-19 pandemic in terms of fiscal and monetary policy thanks to its stable and disciplined macroeconomic policies with low internal and external debt and low inflation. However, as a key agricultural exporter, the country remains vulnerable to international price volatility and climate change-related challenges.

© 2023 (March), Alliance for Financial Inclusion. All rights reserved.

ZIMBABWE CASE STUDY

A landlocked country rich in natural resources which support both agriculture and tourism, Zimbabwe is progressively working towards securing a stable investment climate.

© 2023 (April), Alliance for Financial Inclusion. All rights reserved.

AFI Special Report • Blog: In times of crisis, Financial Inclusion with a focus on Women is not a distraction but actually a force- multiplier

Author:

Benedikt Wahler, Partner

Date:

June 16th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Crisis Response • Resilience Building • Research

In times of crisis, Financial Inclusion with a focus on Women is not a distraction but actually a force- multiplier – as highlighted by a new Special Report of the Alliance for Financial Inclusion (AFI) prepared by CCX. The COVID-19 pandemic has not just been a call to action but also a hotbed of innovation, testing and learning.

A new Special Report published by AFI, analyses the global set of experiences of financial sector policymakers, regulators and financial institutions, and provides recommendations: financial inclusion policy, particularly with a focus on Gender Inclusive Finance (GIF) leads to more effective policy response when a crisis is on as well as faster recovery and better resilience to future crises. In other words: a focus on women is the way to Build Back Better in the financial sector.

Gaps between women and men in the access to and usage of formal financial services, such as bank accounts, credit facilities, and insurance remain large and in a few regions were even growing. Before the COVID-19 pandemic, Gender Inclusive Finance (GIF), therefore, was a policy priority in many emerging markets. Already in 2016, the members of the Alliance for Finance Inclusion – central banks and financial regulatory institutions from 76 developing countries – committed to halving these gender gaps in the Denarau Action Plan. But a fast-moving crisis that disrupted social and economic life might seem to suggest such priorities have to wait.

With deep-dive research, extensive stakeholder interviews, a survey of one-third of AFI members and the financial inclusion policy and solution design expertise of our team, ConsumerCentriX (CCX) supported AFI to explore the nexus of women’s financial inclusion and crisis response in the project “Closing the Financial Inclusion Gender Gap During the Crisis and Afterward”.

The evidence from pioneering AFI member experiences is clear and borne out in macroeconomic data and numbers of active users of financial services. Without a focus on women as the largest group of at-risk, under-served citizens, crises linger, recovery is slower and less stable, and countries can catch a case of “economic long-COVID”.

AFI members like Paraguay, Fiji, Egypt, Bangladesh, Zimbabwe, Togo, Ghana, and Rwanda show that even under the pressures of crisis, Gender Inclusive Finance should be in focus. It helps set the right priorities, mobilise the most impactful set of stakeholders, identify the key operational challenges, and target beneficiaries with a large multiplier effect. Enabled by the opportunities of digital finance that can be ramped up fast even for poor countries that had so far seen limited adoption, GIF gets crisis relief and stimulus to where it is needed most and makes sure economic life can continue.

Some of the key recommendations for policymakers and financial services providers include:

Policymakers (central banks, regulators, supervisors)

- Support the development and use of digital financial services as an enabler and crisis-proofing of financial sector operations. Benchmarked against women’s needs and constraints, it will deliver the widest adoption – especially in areas likely the hardest to reach in times of crisis. For example, one of Africa’s poorer and smaller economies, Togo was able to launch payments to informal workers – many of them women -within 14 days and ramp it up to 1 in 5 adults.

- Make sure that new users who signed up during the crisis remain active users of formal (digital) financial services – and don’t revert to cash or informal practices. Women as financial managers of the household are key. Incentives, financial literacy, and consumer protection can help entrench these new practices of using financial services. What counts most are reliable, lost-cost everyday use cases: sending money to family and friends, paying for groceries – enable such ecosystems so that money that arrives from government support remains cashless.

Financial services providers (banks, MFIs, Fintechs, insurance companies)

- Building cashflow-based and digitally-enabled lending solutions ahead of a crisis makes the short-term liquidity support easier to deploy when crises hit. Women, as consistently better re-payers even in times of a global pandemic, are loyal clients, and as the financial managers of their households, they should be at the center of efforts to create these lending solutions. Using human-centred design that focuses on their needs and constraints is the approach to get it right.

- Partner with other organizations to promote financial inclusion for women, such as NGOs, government agencies, or business development skills providers where possible to enhance your reach among women. This can be done through providing non-financial services, such as business development training tailored to the needs of women entrepreneurs.

- Actively engage regulators in financial inclusion working groups to help shape Gender Inclusive Finance and be able to draw on established lines of communication and collaboration when crisis hits. This will lead to pragmatic and impactful policies.

In addition to the 5 case studies that are already published, ConsumerCentriX and the Alliance for Financial Inclusion will soon also share a policy toolkit to operationalize the recommendations from the special report. Stay tuned for more updates.

To access the report, visit: “Closing the Financial Inclusion Gender Gap During the Crisis and Afterwards” project special report.