Strategies for Financial Service Providers to Access Colombia's Untapped MSME Market

Author: Laura Trueba, Head of Latin America and the Caribbean

Co-author: Musa Kacheche, Corporate Communications Lead

Date: June 28th, 2024

Area Covered: Latin America and the Caribbean

Topics:

MSME Banking • Financial Inclusion • MSME Research • Market Segmentation

The Current State of MSME Banking

Micro, small, and medium-sized enterprises (MSMEs) are crucial to the economic fabric of Latin America and the Caribbean. In Colombia, they account for 99% of companies, 80% of private employment, and 35% of GDP. Despite their significance, MSMEs in Colombia remain underserved. They receive only 14% of total commercial loans, facing a financing gap estimated at $56.2 billion—19% of the 2017 GDP—for formal MSMEs alone. Informal companies face an additional financing gap of 10% of GDP, while women-owned MSMEs experience a shortfall of $6.1 billion.

Addressing this gap requires continued efforts by the government and financial institutions to develop innovative solutions that meet the unique needs of MSMEs in the Colombian market. With funding from the Argidius Foundation, ConsumerCentriX conducted a market feasibility study to identify barriers to access finance for MSMEs in Colombia. The study involved customer research engaging business owners in Bogota and Medellin and a market analysis involving interviews with key industry stakeholders, such as financial service providers (FSPs), government institutions and other MSME ecosystem partners.

Understanding Customer Perspectives

Despite a dynamic MSME sector with over 5.7 million enterprises, Colombia’s 1.4 million registered micro-enterprises face a vast gap in accessing financial services. These businesses often rely on retail banking solutions rather than tailored business products. For instance, they often opt for personal loans over business loans due to stricter requirements, lengthy approval processes, and high fees associated with the latter. While personal loans are more accessible, they often come with higher interest rates and rigid repayment terms, which do not align with the financial needs of the businesses. Additionally, most entrepreneurs are unaware of the offerings from the largest banks, and those familiar with them find the products unsuitable. Colombia’s registered microenterprises tend to be “multi-banked,” meaning they use financial services from different institutions, seeking the most favorable options. For example, they may take out personal loans, open deposit accounts, or access business credit from various banks. As a result, these businesses do not depend on comprehensive solutions from a single FSP but diversify their services across multiple providers.

Moreover, MSMEs in Colombia value having a dedicated point of contact at their bank, such as a relationship manager who understands their business and can offer personalized advice. The availability of knowledgeable financial advisors or loan officers helps MSMEs make complex financial decisions and grow their businesses. Furthermore, MSME owners expressed a need for non-financial services, such as business training and access to networks, to support their growth. Many business owners whose educational backgrounds may not prepare them for a growing business seek opportunities to develop essential skills and knowledge. Colombia has a diverse ecosystem of MSME support institutions, but the fragmented landscape makes it difficult for business owners to know where to access these resources.

Understanding the Competitor Landscape

Market analysis reveals intense competition in the small and medium enterprises (SME) banking sector, where major banks offer tailored and holistic market solutions. A similar level of competition exists among microfinance institutions serving the unregistered micro-enterprises. However, a significant opportunity exists within the registered micro-enterprises segment, which remains largely underserved by financial service providers.

Despite the evident need for financing among registered micro-enterprises, banks remain cautious due to perceived credit risks. Most financial institutions prefer lending to well-organized SMEs, focusing on legal entities and secured loans backed by government programs like the National Guarantee Fund (FNG), mortgages, or leasing programs. For microfinance institutions, the challenge is adapting their models—both in terms of human resources and product portfolios—to meet the needs of formal businesses. Offering lower-cost financing and overcoming the challenge of building brand recognition are additional obstacles in this space.

To differentiate themselves, FSPs should offer financing solutions that help registered micro-businesses achieve short- and long-term goals, such as purchasing machinery, expanding locations, acquiring raw materials, or maintaining cash flow with suppliers. These businesses expect low interest rates, simple requirements, fast approval, and transparent information. They also desire flexible repayment options and personal guidance from advisors who can explain the products and recommend the best options.

In conclusion, Colombia’s financial service sector holds significant potential for serving the registered micro-enterprise segment. By partnering with business development service providers and other key ecosystem players to bridge the skills gap, FSPs can position themselves as critical enablers of the growth and development of this segment in Colombia.

Examining Key Financial Inclusion Barriers in the LAC Region through ConsumerCentriX's Ecosystem-Centric Engagements

Author:

Laura Trueba, Head of Latin America and the Caribbean

Date:

June 28th, 2024

Area Covered:

Latin America and the Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Gender-Inclusive Finance• Financial Regulation • Digital Financial Services

In the past two years, ConsumerCentriX (CCX) has undertaken important projects aimed at addressing barriers to financial inclusion in the Latin America and Caribbean (LAC) region. Drawing upon years of experience and more recent engagements, which included collaboration with Multilateral Development Banks (MDB), regulators and financial service providers (FSPs), CCX has an ecosystem-centric understanding of the financial inclusion landscape in the region. This approach has allowed us to identify and address the major challenges hindering greater financial inclusion in the region. To shed light on these major challenges, this blog will highlight some significant barriers.

Among the interventions that have empowered CCX to gain this valuable understanding include the Supply-side Sex-disaggregated Data Survey, commissioned by IDB Invest, reaching 13 LAC countries. This survey covered over 240 financial service providers in the region to understand their strategies for the women’s market, including mapping their financial and non-financial product offerings and their use of sex-disaggregated data. This resulted in a publication, “Women Rising“, highlighting, among many other insights, the untapped revenue potential in the women’s market, ranging from $1.87 billion in Mexico to $283 million in Guatemala.

Regarding the state of financial inclusion of women micro, small and medium businesses (WMSME), CCX has been recruited by IDB Invest to support the successful implementation of the Women Entrepreneur Finance Code (We-Fi Code) in the Dominican Republic. This will involve enhancing the capacity of the Asociación de Bancos Múltiples (ABA) as the local Aggregator and Coordinator, as well as FSPs, to fulfil the commitments of the Code.

On the regulatory side, CCX collaborated with the Alliance for Financial Inclusion (AFI) to develop a Gender-Inclusive Finance (GIF) Roadmap for AFI 11 member countries in the LAC region. This initiative aimed to systematically review practical policy actions to enhance women’s financial inclusion and reduce gender gaps. CCX also worked with AFI to conduct case studies of 13 countries, including eight from the LAC region, to understand the role regulators play in closing the financial inclusion gender gap.

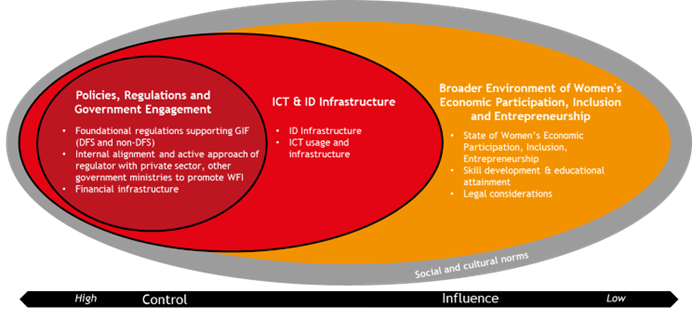

To conduct these case studies, an Analytical Framework for Inclusive Finance with a Gender Perspective was developed in partnership with AFI that comprises four key spheres that impact the state of financial inclusion in a country, such as 1) FSP’s actions towards women’s financial inclusion, 2) Policies, Regulations, and Government Engagement, 3) ICT and ID Infrastructure, and 4) the Broader Environment of Women’s Economic Participation, Inclusion, and Entrepreneurship.

Unveiling Financial Inclusion Disparities Between Rapidly Progressing and Slower Progressing Countries

- Delving into the regulatory landscape

Following our assessments and employing the AFI Framework for Inclusive Finance with a Gender Perspective as the analytical cornerstone, a significant disparity is observed between countries with limited financial inclusion and those that have made substantial progress. This disparity primarily revolves around the availability of financial infrastructure, the network of banking agents, their outreach, and utilization, which must also include mobile money/digital solutions services. Some developed regulations lack a digital financial services component, particularly concerning the interoperability of mobile banking, primarily within banking agents.

Interoperability, Open Banking, and National Financial Inclusion Policy in Perú

The Central Reserve Bank of Perú (BCRP) has been working on increasing interoperability to promote digital payments and financial technology and further drive financial inclusion. As of 2021, 44% of women and 55% of men reported making or receiving a digital payment to Global Findex, which is high for the region. To support the prevalence of digital payments, the BCRP has worked to strengthen retail interoperability, especially since the COVID-19 Pandemic. Today, over 100,000 retailers across the country are compatible with e-money. The BCRP has stated that payment providers must be interoperable, setting an implementation schedule for interoperability. The BCRP also runs the payment switch for interbank transfers, checks, ATMs, and mobile money, all integrated under the real-time gross settlement system.

Furthermore, we have observed that alongside mobile interoperability, there is a crucial need to ensure adequate regulation of mobile and digital financial services. Such regulation should permit electronic wallets for retail payments, facilitate the opening of e-wallets without mandatory linkage to a bank account, and enable digital customer identification (e-KYC) for individuals to open e-wallets or basic bank accounts remotely.

E-Wallets in El Salvador

E-wallets in El Salvador are driving financial inclusion, with uptake that is outpacing that of traditional bank accounts. In 2015, the country passed the Law to Facilitate Financial Inclusion; while the law spans many areas including tiered KYC, arguably its most important provision is the regulation of e-wallet providers and savings accounts with simplified requirements. The law imposes disclosure requirements, consumer protection standards, provides transaction limits for agent banking, and authorizes banks to issue their own mobile money services.

By paving the way for e-money and its use in the country, the law resulted in explosive growth of the MNO Millcom’s Tigo Money. Today, over 1 million Tigo Money accounts exist in El Salvador, representing about 20 percent of the adult population, which is immense compared to the 29% of women and 45% of men who own a bank account according to Findex 2021.[1]

More recently, in 2021, El Salvador’s government passed the Bitcoin Law and the roll-out of Chivo, a government-owned e-wallet for cryptocurrency and dollars. As of 2021, 3 million Salvadorians have downloaded the app and created an account, amounting to 46% of the population, 52 percent of which are women.

- Delving into the financial service provider landscape

According to the IDB Invest Supply-side Sex-disaggregated Data Research Survey, most FSPs in the region focus on the women’s market but still consider it part of their corporate social responsibility strategy. There is a clear knowledge gap on the business case and profitability of serving the women’s market, attributed to a lack of capacity to collect, use and analyze sex-disaggregated data. Moreover, without this data, FSPs are unable to develop holistic women’s market strategies, which are crucial for designing and marketing offers and products aimed at women clients.

While 75% of commercial banks in the region reported collecting sex-disaggregated data, over half (52%) continue to use manual reporting processes, which raises concerns about data quality, and most still have not established key performance indicators (KPIs). Furthermore, FSPs with advanced market strategies generally do not leverage the available data to evaluate return on investment or profitability.

As a result, they overlook clear business expansion opportunities, given their lack of emphasis on profitability as a reason for targeting the women’s market. By not thoroughly analyzing their existing data, FSPs may be missing a crucial business strategy for enhancing their focus on women.

Addressing financial inclusion barriers in the LAC region is crucial for socio-economic development. This requires collaborative efforts from regulators, FSPs, public entities, civil society organizations, and development partners. By continuing to innovate and adapt, CCX is paving the way for a more financially inclusive future.

Empowering Women Entrepreneurs in Sub-Saharan Africa through the Africa Women Rising Initiative

Author:

Benedikt Wahler, partner

Date:

June 26th, 2024

Area Covered:

Africa, Sub-Saharan Africa

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

For the last four years, ConsumerCentriX, in collaboration with the International Project Consult (IPC) and the African Management Institute, has supported the implementation of the Africa Women Rising Initiative (AWRI), funded by the European Investment Bank (EIB). In mid-June, Benedikt Wahler and Dörte Weidig, partners at ConsumerCentriX and IPC, respectively, delivered a “Knowledge Lab” session in Luxembourg to the EIB community to share the large-scale impacts and lessons from this work.

This initiative aims to empower women economically in Sub-Saharan Africa by increasing their access to finance and capacity-building resources, particularly for women entrepreneurs, owners, and leaders in micro, small, and medium enterprises (MSMEs), in alignment with the 2X Challenge criteria.

AWRI Pilots and Builds a Foundation for Mobilizing Large-Scale Gender Finance

As part of the broader “SheInvest” initiative, through which the EIB is mobilizing EUR 2 billion of funding for gender-responsive investments in Africa, AWRI was launched in April 2020. This occurred just as Africa was experiencing the first wave of the COVID-19 pandemic to complement these funds with technical assistance (TA) from the consortium partners.

From the ConsumerCentriX team and our professional network, we contributed the Team Lead, interim team lead, and several senior experts on key factors for the success of gender-inclusive finance: unsecured and cashflow-based lending, market research, strategy and value proposition design, as well as facilitating the work of cross-functional teams to pilot new approaches. Our data team also helped ensure the recommendations reflected a sound basis of analysis and insights.

ConsumerCentriX Managing Director Benedikt Wahler, who stepped up from key expert to interim Team Lead during a medical leave, feels that “AWRI really showed once more the full breadth of expertise we were able to mobilize and the deep bench of colleagues to make one more multi-year, multi-country, and multi-institution TA a success.” It was another instance of a close and successful collaboration with IPC, alongside current joint activities on “Youth-in-Business” and the upcoming Central Asia WE Finance Code.

Thanks to AWRI, nine financial intermediaries (FIs) across four countries – Uganda, Rwanda, Senegal, and Côte d’Ivoire – received customized assistance based on a thorough assessment of their needs, the realities of their clients, and their local market context. In addition to four commercial banks (Bank of Kigali, Ecobank Group, Housing Finance Bank, Atlantic Business International), four microfinance institutions (Pride Microfinance, Centenary Bank, Baobab Senegal, Baobab Côte d’Ivoire), and one development bank (Development Bank of Rwanda) were supported on gender finance.

Before this work started, ConsumerCentriX pioneered a data-driven approach to identifying the right countries for gender finance interventions like AWRI. Using a proprietary benchmarking tool that considers four main dimensions of women’s economic, social, and financial inclusion, we screened and scored 45 economies in Sub-Saharan Africa.

The implementation focused on two main components: “Banking on Change” and “Market Maker.” “Banking on Change” targeted the supply side by enhancing the capability of financial institutions to meet the needs of women entrepreneurs with gender-intelligent products and services, while “Market Maker” focused on the demand side, strengthening women entrepreneurs’ financial and business skills and their networks.

Through the Market Maker initiative, AWRI significantly enhanced women entrepreneurs’ financial literacy and business management skills. Training programs reached 1,087 women, covering essential topics such as financial literacy, record-keeping, customer service, and soft skills. Forty per cent of the participating businesswomen subsequently obtained loans. This initiative also developed 11 non-financial services (NFS) modules tailored to the needs of women entrepreneurs, further supporting their business growth and sustainability. The impact of these efforts was evident, with many women reporting improved business practices and enhanced financial management skills.

The AWRI’s Banking on Change component focused on strengthening the capabilities of partner financial institutions (PFIs) to better serve women entrepreneurs. This included conducting comprehensive institutional diagnostics and capacity needs assessments, followed by tailored technical assistance packages delivered by a team of international and local experts. At two institutions, unsecured loan products and the respective credit processes were developed for the first time. Two others deployed their first-ever savings products tailored to businesswomen, leading to strong growth in their funding base.

Even though most improved solutions were still in the early stages of roll-out, the results were strongly positive. The number and volume of loans grew faster for women than men at all institutions. The portfolios now include 35,400 more women borrowers and EUR 67 million. Compared to the pre-AWRI baseline, our team helped advance the frontiers of inclusion: 16,000 women borrowers who otherwise would not have been expected to receive loans and EUR 40 million in loan volume. All of this was achieved while not merely preserving but even expanding the better repayment performance of women borrowers.

Why Gender Finance is the Right Approach for Impact and Commercial Success

The 2X Collaborative, of which EIB is a founding member, documents the growing momentum among the community of development finance institutions and related stakeholders that a dedicated focus on women (also known as a Gender Lens) delivers better impact. The evidence collected over the past decade by programs like the IFC’s “Banking on Women” or the Financial Alliance for Women from pioneering banks, MFIs, and fintechs around the world makes it clear that there is also a strong strategic and business case for targeting women and women SMEs as clients. At ConsumerCentriX, this reality and our expertise on what that should mean in practice drive around two-thirds of our work.

For those who care about impact, the case for being intentional in focusing on women should be straightforward: though women and men are diverse among themselves, on the criteria that matter for their ability to access and use conventional financial services, women score lower on average.

In the regional context of AWRI in Sub-Saharan Africa, women entrepreneurs face numerous challenges in operating and growing their businesses: less revenue and often smaller businesses in low-margin sectors, lower levels of secondary education and less professional experience in the formal sector, less likely to have mentors, and more limited access to capacity building, supportive networks, and market information. They are also often far less able to post the kind of assets required as collateral to obtain loans.

To truly deliver on the ambition of building an inclusive financial system that can power sustainable and broad-based economic growth, solutions ought to be benchmarked against the realities of such women – in other words, be “gender-intelligent.” To genuinely aim for reaching the marginalized parts among women and other groups, those experiencing the highest levels of such challenges should set the tone, thereby aiming for solutions that stand a chance of being “gender-transformative,” i.e., over time, wearing down these challenges rather than just working around them. The reality of supposedly fair “gender-neutral” approaches is that they are bound to fall short of most women and even a good portion of male users of financial services. They are designed for a type of client who is just not representative of the population at large – let alone those at the frontier of the financial system. (see charts below)

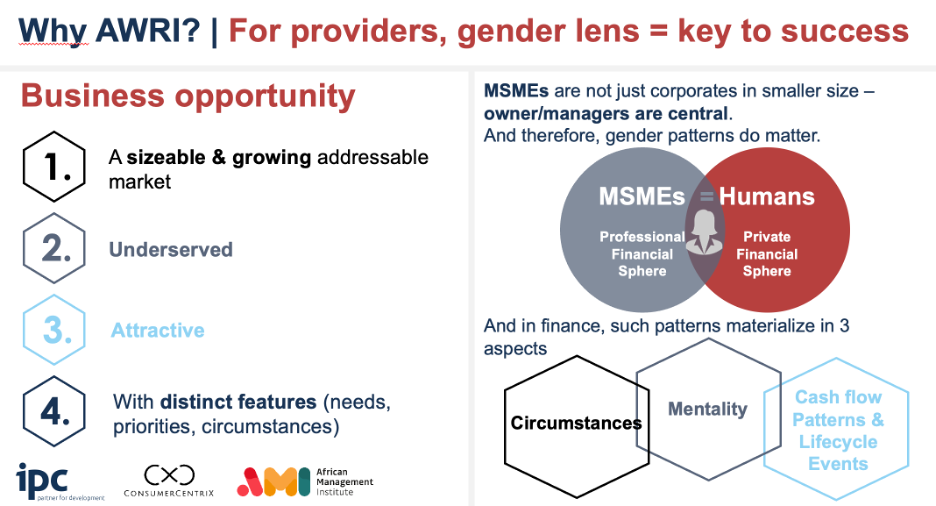

In the AWRI program – as in most of our work – we were tasked with working with for-profit financial service providers. There is now a strong basis of evidence that women and women’s businesses constitute a clear business opportunity. But business bankers tend to ask why they’d need to become “gender-intelligent” in their work. Is not a business and a leasing contract a leasing contract, whoever sits on the client side of the relationship?

For the ConsumerCentriX team, the answer is clear: to actually seize that opportunity, bank executives do well to look closer and remind themselves that what sets MSMEs apart is not that they’re smaller than big firms. It’s the human(s) at the heart of these businesses. The owners and managers whose ambitions, outlook, and idiosyncrasies shape what the business will end up doing – and this is why gender patterns matter. In the space of finance, such patterns emerge 1) from the legal, family, and socio-cultural circumstances in which women have to operate, 2) the mentality and attitudes they bring to financial questions, and 3) the way in which their cashflows are (much more strongly) exposed to lifecycle events like marriage, childbirth, divorce, or care for elderly parents. (see below)

Notably, the success stories featured at events like the Financial Alliance for Women’s Annual Summit come from institutions that have taken such insights into action. This year’s edition in London included two Champions, Access Bank Group from Nigeria and Kenya Commercial Bank, who referred to business banking solutions that emerged from their work with our own Anna Gincherman and Benedikt Wahler.

As Benedikt summed it up: “With the now concluded AWRI program, our team is proud to have laid excellent foundations for seeing more such pioneering examples scale up in Africa.”

Blog: Unlocking the Women's Market: Comprehensive Strategies for Financial Institutions to Engage the Lucrative Women's Market

Author:

Laura Trueba, Head of Latin America

Date:

February 22nd, 2024

Area Covered:

Latin America, Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

Significant progress has been made in women’s financial inclusion across Latin America and the Caribbean, with the gender gap for account ownership declining by two percentage points between 2017 and 2021, according to the 2021 World Bank Global Findex report. However, many women, specifically female entrepreneurs, remain underserved or excluded from formal financial systems. To better understand the state of women’s financial inclusion and how financial institutions can expand access, IDB Invest partnered with ConsumerCentriX on a new research study entitled “Women Entrepreneurs on the Rise: A study on the growing financial power of the female market in Latin America and the Caribbean and what this means for financial institutions” The report is the result of a study conducted in over 13 countries in the LAC region with the participation of over 240 financial institutions that assessed the availability of financial offers and strategies that such institutions use to serve women and how they collect and utilize sex-disaggregated data. This blog summarises critical insights from the study, focusing on the state of women’s banking as a significant business differentiator and its potential to strengthen the competitive positioning of financial institutions in the region.

Findings from the research study indicate that women represent a significant portion of financial institutions’ customer base. The research illustrates that female-owned businesses constitute nearly 50% of retail and business customers in the region. Additionally, the research demonstrated that there have been higher growth rates of women’s market portfolios, with individual banks reporting substantial compound annual growth rates (CAGRs), surpassing those of the total portfolio. Such findings reinforce the message that neglecting the expanding financial influence of the women’s market and its diverse customer segments could weaken overall institutional positioning.

The findings also indicate that the degree of ambition and progress regarding leveraging female-owned businesses varies from country to country, depending on the types of financial institutions. Of the banks with products that appeal to the female market, the majority view them through the lens of corporate social responsibility (CSR) or as part of their environmental, social, and governance (ESG) initiatives rather than recognizing them as mainstream growth opportunities. This highlights a prevalent perspective in which women’s market propositions are often considered ancillary to broader social and developmental goals within the banking sector.

Unlike the region’s microfinance institutions, development banks, and cooperatives, which generally share the aforementioned perspective, the fintech sector emerges as a distinct and proactive player. In contrast to most traditional financial institutions in Latin America, who often lack dedicated strategies, fintech companies lead the way with a more driven approach, underscoring the imperative for traditional financial institutions to reassess their strategies.

Findings from the research study also highlight the importance of prioritizing the women’s market for business purposes, revealing a noteworthy trend in loan repayment and deposit behavior. The study found that female retail and business customers consistently demonstrated higher loan repayment rates than their male counterparts, as illustrated by a substantial difference in the 90-day non-performing loan (NPL) ratios. For instance, the average 90-day NPL ratio for female retail customers in commercial banks is a commendable 2.7%, well below men’s 4% average. Previous studies have identified a strong correlation between lower NPL ratios and increased bank profitability.

The increasing interest from financial institutions in the region to serve the women’s market is also evident. The study indicated that approximately one-third of financial institutions currently have a strategy to serve the women’s market, and over 40% are developing one. It also demonstrated that an increasing number of financial institutions are incorporating non-financial services into their women-focused propositions and more robustly collecting sex-disaggregated data, particularly regarding retail portfolios. This continued strategic focus on women, along with improved collection and use of gender data, is likely helping to reduce the gender gap over time by informing more inclusive approaches that have already shown women can be profitable customers.

Despite the growing interest in serving the female market among financial institutions in the region, these institutions have yet to capture this significant market potential. Some key strategies for them to do so and to ultimately advance women’s financial inclusion in the LAC region include:

- Comprehensive women’s market propositions: Financial institutions can develop comprehensive women’s market propositions that involve products tailored to women’s needs and priorities. For instance, institutions like Banco Visión in Paraguay have developed offerings beyond single products to address women’s diverse needs through preferential rates, minimum requirements tailored to female entrepreneurs, partner discounts at women-owned businesses, and insurance partnerships explicitly designed for women.

- Common WSME definition: As discussed in the report, the lack of a universal definition of women-owned/led SMEs across countries and institutions makes it difficult for financial providers to identify and serve this vital segment. A standardized approach would help address this challenge.

- Enhanced gender data: As previously mentioned, most institutions track sex-disaggregated data. However, improving quality, automating the collection, and ensuring data is gathered regarding a wide range of financial services beyond just credit would give providers deeper insights to develop more impactful women-focused strategies and measure their effectiveness over time.

- Integrating gender data into Key Performance Indicators (KPIs): Only half of the surveyed institutions currently incorporate gender performance metrics into management indicators, as noted. Regular tracking and reporting on progress towards gender-focused KPIs could help hold management accountable for women’s market strategy.

Generating a Gender-Inclusive Finance Roadmap for Latin America and the Caribbean.

Author:

ConsumerCentriX Project Team

Date:

November 22nd, 2023

Area Covered:

Latin America • Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

ConsumerCentriX (CCX), in partnership with the Alliance for Financial Inclusion (AFI), is working to develop a gender-inclusive finance (GIF) roadmap for AFI member countries in the Latin America and Caribbean (LAC) region. The project seeks to address the lack of systematic review of practical policy actions that AFI members in the LAC region can undertake to increase women’s financial inclusion and reduce their gender gaps.

With extensive experience from working with AFI on two projects, part of the AFI Gender Inclusive Finance Workstream, the CCX team, led by Partner Anna Gincherman, will undertake three primary tasks, including:

- Assessing the state of financial inclusion in the LAC region, highlight the significant milestones, targets, and drivers for women’s financial inclusion

- Identifying key barriers and opportunities to women’s financial inclusion in the LAC region

- Identifying main areas of focus for regulators and implementation initiatives in the LAC region based on the best practices and the region’s own unique needs

Through extensive secondary and primary research, the CCX team will develop a GIF landscape report for the LAC region covering the main barriers and opportunities for women’s financial inclusion, with recommendations and an implementation plan based on the key findings from the research.