Empowering Women Entrepreneurs in Sub-Saharan Africa through the Africa Women Rising Initiative

Author:

Benedikt Wahler, partner

Date:

June 26th, 2024

Area Covered:

Africa, Sub-Saharan Africa

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

For the last four years, ConsumerCentriX, in collaboration with the International Project Consult (IPC) and the African Management Institute, has supported the implementation of the Africa Women Rising Initiative (AWRI), funded by the European Investment Bank (EIB). In mid-June, Benedikt Wahler and Dörte Weidig, partners at ConsumerCentriX and IPC, respectively, delivered a “Knowledge Lab” session in Luxembourg to the EIB community to share the large-scale impacts and lessons from this work.

This initiative aims to empower women economically in Sub-Saharan Africa by increasing their access to finance and capacity-building resources, particularly for women entrepreneurs, owners, and leaders in micro, small, and medium enterprises (MSMEs), in alignment with the 2X Challenge criteria.

AWRI Pilots and Builds a Foundation for Mobilizing Large-Scale Gender Finance

As part of the broader “SheInvest” initiative, through which the EIB is mobilizing EUR 2 billion of funding for gender-responsive investments in Africa, AWRI was launched in April 2020. This occurred just as Africa was experiencing the first wave of the COVID-19 pandemic to complement these funds with technical assistance (TA) from the consortium partners.

From the ConsumerCentriX team and our professional network, we contributed the Team Lead, interim team lead, and several senior experts on key factors for the success of gender-inclusive finance: unsecured and cashflow-based lending, market research, strategy and value proposition design, as well as facilitating the work of cross-functional teams to pilot new approaches. Our data team also helped ensure the recommendations reflected a sound basis of analysis and insights.

ConsumerCentriX Managing Director Benedikt Wahler, who stepped up from key expert to interim Team Lead during a medical leave, feels that “AWRI really showed once more the full breadth of expertise we were able to mobilize and the deep bench of colleagues to make one more multi-year, multi-country, and multi-institution TA a success.” It was another instance of a close and successful collaboration with IPC, alongside current joint activities on “Youth-in-Business” and the upcoming Central Asia WE Finance Code.

Thanks to AWRI, nine financial intermediaries (FIs) across four countries – Uganda, Rwanda, Senegal, and Côte d’Ivoire – received customized assistance based on a thorough assessment of their needs, the realities of their clients, and their local market context. In addition to four commercial banks (Bank of Kigali, Ecobank Group, Housing Finance Bank, Atlantic Business International), four microfinance institutions (Pride Microfinance, Centenary Bank, Baobab Senegal, Baobab Côte d’Ivoire), and one development bank (Development Bank of Rwanda) were supported on gender finance.

Before this work started, ConsumerCentriX pioneered a data-driven approach to identifying the right countries for gender finance interventions like AWRI. Using a proprietary benchmarking tool that considers four main dimensions of women’s economic, social, and financial inclusion, we screened and scored 45 economies in Sub-Saharan Africa.

The implementation focused on two main components: “Banking on Change” and “Market Maker.” “Banking on Change” targeted the supply side by enhancing the capability of financial institutions to meet the needs of women entrepreneurs with gender-intelligent products and services, while “Market Maker” focused on the demand side, strengthening women entrepreneurs’ financial and business skills and their networks.

Through the Market Maker initiative, AWRI significantly enhanced women entrepreneurs’ financial literacy and business management skills. Training programs reached 1,087 women, covering essential topics such as financial literacy, record-keeping, customer service, and soft skills. Forty per cent of the participating businesswomen subsequently obtained loans. This initiative also developed 11 non-financial services (NFS) modules tailored to the needs of women entrepreneurs, further supporting their business growth and sustainability. The impact of these efforts was evident, with many women reporting improved business practices and enhanced financial management skills.

The AWRI’s Banking on Change component focused on strengthening the capabilities of partner financial institutions (PFIs) to better serve women entrepreneurs. This included conducting comprehensive institutional diagnostics and capacity needs assessments, followed by tailored technical assistance packages delivered by a team of international and local experts. At two institutions, unsecured loan products and the respective credit processes were developed for the first time. Two others deployed their first-ever savings products tailored to businesswomen, leading to strong growth in their funding base.

Even though most improved solutions were still in the early stages of roll-out, the results were strongly positive. The number and volume of loans grew faster for women than men at all institutions. The portfolios now include 35,400 more women borrowers and EUR 67 million. Compared to the pre-AWRI baseline, our team helped advance the frontiers of inclusion: 16,000 women borrowers who otherwise would not have been expected to receive loans and EUR 40 million in loan volume. All of this was achieved while not merely preserving but even expanding the better repayment performance of women borrowers.

Why Gender Finance is the Right Approach for Impact and Commercial Success

The 2X Collaborative, of which EIB is a founding member, documents the growing momentum among the community of development finance institutions and related stakeholders that a dedicated focus on women (also known as a Gender Lens) delivers better impact. The evidence collected over the past decade by programs like the IFC’s “Banking on Women” or the Financial Alliance for Women from pioneering banks, MFIs, and fintechs around the world makes it clear that there is also a strong strategic and business case for targeting women and women SMEs as clients. At ConsumerCentriX, this reality and our expertise on what that should mean in practice drive around two-thirds of our work.

For those who care about impact, the case for being intentional in focusing on women should be straightforward: though women and men are diverse among themselves, on the criteria that matter for their ability to access and use conventional financial services, women score lower on average.

In the regional context of AWRI in Sub-Saharan Africa, women entrepreneurs face numerous challenges in operating and growing their businesses: less revenue and often smaller businesses in low-margin sectors, lower levels of secondary education and less professional experience in the formal sector, less likely to have mentors, and more limited access to capacity building, supportive networks, and market information. They are also often far less able to post the kind of assets required as collateral to obtain loans.

To truly deliver on the ambition of building an inclusive financial system that can power sustainable and broad-based economic growth, solutions ought to be benchmarked against the realities of such women – in other words, be “gender-intelligent.” To genuinely aim for reaching the marginalized parts among women and other groups, those experiencing the highest levels of such challenges should set the tone, thereby aiming for solutions that stand a chance of being “gender-transformative,” i.e., over time, wearing down these challenges rather than just working around them. The reality of supposedly fair “gender-neutral” approaches is that they are bound to fall short of most women and even a good portion of male users of financial services. They are designed for a type of client who is just not representative of the population at large – let alone those at the frontier of the financial system. (see charts below)

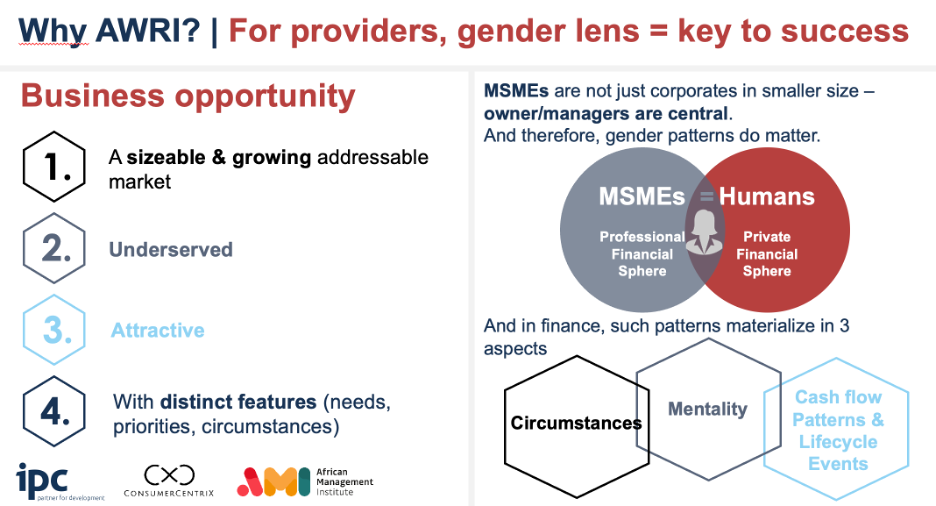

In the AWRI program – as in most of our work – we were tasked with working with for-profit financial service providers. There is now a strong basis of evidence that women and women’s businesses constitute a clear business opportunity. But business bankers tend to ask why they’d need to become “gender-intelligent” in their work. Is not a business and a leasing contract a leasing contract, whoever sits on the client side of the relationship?

For the ConsumerCentriX team, the answer is clear: to actually seize that opportunity, bank executives do well to look closer and remind themselves that what sets MSMEs apart is not that they’re smaller than big firms. It’s the human(s) at the heart of these businesses. The owners and managers whose ambitions, outlook, and idiosyncrasies shape what the business will end up doing – and this is why gender patterns matter. In the space of finance, such patterns emerge 1) from the legal, family, and socio-cultural circumstances in which women have to operate, 2) the mentality and attitudes they bring to financial questions, and 3) the way in which their cashflows are (much more strongly) exposed to lifecycle events like marriage, childbirth, divorce, or care for elderly parents. (see below)

Notably, the success stories featured at events like the Financial Alliance for Women’s Annual Summit come from institutions that have taken such insights into action. This year’s edition in London included two Champions, Access Bank Group from Nigeria and Kenya Commercial Bank, who referred to business banking solutions that emerged from their work with our own Anna Gincherman and Benedikt Wahler.

As Benedikt summed it up: “With the now concluded AWRI program, our team is proud to have laid excellent foundations for seeing more such pioneering examples scale up in Africa.”

Blog: Unlocking the Women's Market: Comprehensive Strategies for Financial Institutions to Engage the Lucrative Women's Market

Author:

Laura Trueba, Head of Latin America

Date:

February 22nd, 2024

Area Covered:

Latin America, Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

Significant progress has been made in women’s financial inclusion across Latin America and the Caribbean, with the gender gap for account ownership declining by two percentage points between 2017 and 2021, according to the 2021 World Bank Global Findex report. However, many women, specifically female entrepreneurs, remain underserved or excluded from formal financial systems. To better understand the state of women’s financial inclusion and how financial institutions can expand access, IDB Invest partnered with ConsumerCentriX on a new research study entitled “Women Entrepreneurs on the Rise: A study on the growing financial power of the female market in Latin America and the Caribbean and what this means for financial institutions” The report is the result of a study conducted in over 13 countries in the LAC region with the participation of over 240 financial institutions that assessed the availability of financial offers and strategies that such institutions use to serve women and how they collect and utilize sex-disaggregated data. This blog summarises critical insights from the study, focusing on the state of women’s banking as a significant business differentiator and its potential to strengthen the competitive positioning of financial institutions in the region.

Findings from the research study indicate that women represent a significant portion of financial institutions’ customer base. The research illustrates that female-owned businesses constitute nearly 50% of retail and business customers in the region. Additionally, the research demonstrated that there have been higher growth rates of women’s market portfolios, with individual banks reporting substantial compound annual growth rates (CAGRs), surpassing those of the total portfolio. Such findings reinforce the message that neglecting the expanding financial influence of the women’s market and its diverse customer segments could weaken overall institutional positioning.

The findings also indicate that the degree of ambition and progress regarding leveraging female-owned businesses varies from country to country, depending on the types of financial institutions. Of the banks with products that appeal to the female market, the majority view them through the lens of corporate social responsibility (CSR) or as part of their environmental, social, and governance (ESG) initiatives rather than recognizing them as mainstream growth opportunities. This highlights a prevalent perspective in which women’s market propositions are often considered ancillary to broader social and developmental goals within the banking sector.

Unlike the region’s microfinance institutions, development banks, and cooperatives, which generally share the aforementioned perspective, the fintech sector emerges as a distinct and proactive player. In contrast to most traditional financial institutions in Latin America, who often lack dedicated strategies, fintech companies lead the way with a more driven approach, underscoring the imperative for traditional financial institutions to reassess their strategies.

Findings from the research study also highlight the importance of prioritizing the women’s market for business purposes, revealing a noteworthy trend in loan repayment and deposit behavior. The study found that female retail and business customers consistently demonstrated higher loan repayment rates than their male counterparts, as illustrated by a substantial difference in the 90-day non-performing loan (NPL) ratios. For instance, the average 90-day NPL ratio for female retail customers in commercial banks is a commendable 2.7%, well below men’s 4% average. Previous studies have identified a strong correlation between lower NPL ratios and increased bank profitability.

The increasing interest from financial institutions in the region to serve the women’s market is also evident. The study indicated that approximately one-third of financial institutions currently have a strategy to serve the women’s market, and over 40% are developing one. It also demonstrated that an increasing number of financial institutions are incorporating non-financial services into their women-focused propositions and more robustly collecting sex-disaggregated data, particularly regarding retail portfolios. This continued strategic focus on women, along with improved collection and use of gender data, is likely helping to reduce the gender gap over time by informing more inclusive approaches that have already shown women can be profitable customers.

Despite the growing interest in serving the female market among financial institutions in the region, these institutions have yet to capture this significant market potential. Some key strategies for them to do so and to ultimately advance women’s financial inclusion in the LAC region include:

- Comprehensive women’s market propositions: Financial institutions can develop comprehensive women’s market propositions that involve products tailored to women’s needs and priorities. For instance, institutions like Banco Visión in Paraguay have developed offerings beyond single products to address women’s diverse needs through preferential rates, minimum requirements tailored to female entrepreneurs, partner discounts at women-owned businesses, and insurance partnerships explicitly designed for women.

- Common WSME definition: As discussed in the report, the lack of a universal definition of women-owned/led SMEs across countries and institutions makes it difficult for financial providers to identify and serve this vital segment. A standardized approach would help address this challenge.

- Enhanced gender data: As previously mentioned, most institutions track sex-disaggregated data. However, improving quality, automating the collection, and ensuring data is gathered regarding a wide range of financial services beyond just credit would give providers deeper insights to develop more impactful women-focused strategies and measure their effectiveness over time.

- Integrating gender data into Key Performance Indicators (KPIs): Only half of the surveyed institutions currently incorporate gender performance metrics into management indicators, as noted. Regular tracking and reporting on progress towards gender-focused KPIs could help hold management accountable for women’s market strategy.

AFI Policy Toolkit • Blog: A guide to designing Gender-Sensitive Rapid Response and Crisis Recovery Policies

Author:

Benedikt Wahler, Partner

Date:

October 10th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Crisis Response • Resilience Building • Research

Are financial inclusion and the promotion of gender equity “fair weather topics”? How should policymakers set their priorities when a fast-moving crisis fraught with uncertainty and large downside risks requires their full attention, as the COVID-19 pandemic did?

“Actually, weaving a focus on women and their financial inclusion into the design of crisis response is likely to be a force multiplier rather than a distraction”. This is how ConsumerCentriX (CCX) Partner Benedikt Wahler summarizes the team’s research on behalf of the Alliance for Financial Inclusion (AFI), a network of central banks and other financial regulatory institutions from 76 developing countries. Home to the majority of the un- and underbanked, such questions matter a lot to the welfare of these member countries.

The global pandemic confronted policymakers with large-scale and fast-moving disruption. In turn, it also provides a wealth of experiences that this assignment of CCX sought to extract and assess. Over the summer of 2023, AFI shared these in a Special Report “Closing the Financial Inclusion Gender Gap During the Crisis and Afterwards”.

These insights draw upon deep-dive research, interviews with decision-makers and stakeholders, and a survey of more than a third of AFI members facilitated by the Gender Inclusive Finance (GIF) Team at AFI led by Helen Walbey and undertaken by the CCX team as the pandemic evolved over the course of 2021 and 2022. A set of five country case studies draws attention to how large emerging markets like Egypt and small ones like Paraguay or Fiji have been able to effectively respond to this massive crisis with the focus provided by a gender lens and financial inclusion policy.

These experiences should serve as inspiration and provide policymakers with a sense of possibility. But what should executives at central banks or regulatory agencies actually be doing during the next crisis – or even now?

To help provide such guidance, AFI published the “Gender-Sensitive Rapid Response and Crisis Recovery Policies” policy toolkit – a comprehensive guide for policymakers, practitioners, and development partners on designing and implementing gender-sensitive rapid response and crisis recovery policies.

Globally, 740 million women are excluded from financial sector services, and their inclusion could add approximately USD 12 trillion to the global domestic product. This is a vast untapped market for the financial sector. Taking evidence from the experiences of AFI members as expressed in the Special Report, gender-inclusive finance policies can reverse the previously widening gender inequality or access gaps. Besides the additional economic impact, benchmarking policymaking against the realities and constraints of women can strengthen economic stability and growth through improved women’s access to formal financial services, leading to positive outcomes for families and communities. And actually, this approach ends up working better also for many men. This strength of gender-inclusive finance at the center of the policy toolkit is highlighted by what outcomes various shades of gender-inclusive financial policy are likely to deliver – as illustrated in the toolkit here.

Gender-neutral policy designs are often benchmarked by the realities of men, and as a result, they only work for a minority of relatively privileged women. They do not consider the needs and constraints of the average female. The resulting policies or financial offers do not even work well for many men. Gender-intelligent or gender-intentional solutions start by setting the average woman and her constraints as a guideline, and they stand a good chance of adequately serving a majority of women. Gender-transformational policy design explicitly explores the intersectionality of challenges faced by the minority of excluded and marginalized women, and such policy solutions may often require more fundamental interventions.

In disruptions like the COVID-19 pandemic, rapid response and crisis recovery policies that are charged by the power of gender-sensitive design are needed – the AFI Policy toolkit offers three main tools for developing these. The first toolkit explores the role of stakeholders in crisis response. Stakeholders such as donors, ministries and civil society organizations are likely to have networks related to vulnerable groups, and they can help communicate and mobilize interest for interventions in terms of crisis. The second toolkit offers a benchmarking tool for policymakers’ country’s context for gender-inclusive finance. The Excel-based tool developed by ConsumerCentriX allows policymakers to assess the context and baseline necessary for embedding crisis response, recovery and broader financial inclusion policies for AFI members and other stakeholders. The third toolkit explores gender-inclusive crisis response strategies that can be employed depending on the crisis response phase the country is on. These include:

- Fast-paced “fire fighting”

- Enabling recovery

- Building back better for resilience.

Overall, the toolkit provides a valuable resource that enables practitioners at central banks and financial sector regulators, as well as their peers at government ministries to design gender-inclusive financial policies that address barriers to financial inclusion for the majority of vulnerable segments, including women while also allowing them to collect wider sets of data and inputs for improving existing policies and putting in place strategies for future crisis response.

Learn more: AFI Policy Toolkit “Gender-Sensitive Rapid Response and Crisis Recovery Policies

Why the Government and the Private Sector Must Work Together to Expand Access to Digital Financial Services in Guatemala

Author:

John Dorrett, Digital Finance Team, USAID

Note:

This article was originally published on www.marketlinks.org

Date:

July 5th, 2023

Area Covered:

Latin America

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Crisis Response • Resilience Building • Research

Countries in Latin America and the Caribbean are revolutionizing access to banking services and empowering millions of previously unbanked individuals. According to the latest data from the World Bank Findex, 73 percent of people in the region (excluding high-income countries) own a financial account—and the proliferation of digital financial services and financial technology (fintech) played an essential role in this growth. A recent study by the Inter-American Development bank asserts that the size of the fintech industry in Latin America and the Caribbean more than doubled in size in the past three years. According to the same report, the COVID-19 pandemic led to the rapid integration of digital technology across all sectors, including the increased adoption of digital payments platforms.

While the expansion of digital financial services has increased access to financial products, the benefits have not been universal. The World Bank Findex finds that financial inclusion in Guatemala lags behind its neighbors with only 37 percent of the population having an active financial account versus 49 percent in Mexico and 48 percent in Belize. Likewise, Guatemala has not seen a parallel growth in digital financial services; 65 percent of people in the region have made or received a digital payment, while only 26 percent of people have done the same in Guatemala. A recent USAID blog explores how digital finance can deepen financial access and usage among underserved communities in Guatemala. There are two contributing factors to this phenomenon: (1) financial service providers, which include traditional banks, do not see low-income and marginalized populations as bankable, and (2) low-income and marginalized populations, especially women, who do not think financial service providers address their needs or create products with them in mind.

In February 2023, USAID, ConsumerCentriX, and Digital Frontiers, a USAID program run by DAI, co-hosted a workshop to identify gaps and opportunities in the access and use of digital financial services by low-income and marginalized populations, with a particular focus on women. The event brought together more than 50 representatives from the financial sector, including both public and private institutions. As a signal of local government buy-in, a senior representative from the Ministry of Economy opened the event, which also featured a breadth of representatives from regulatory bodies, development organizations, financial services providers, NGOs, and mobile network operators.

The workshop included a review of the latest financial inclusion and digital financial services advancements in Guatemala, an assessment of the enabling environment for further digital financial inclusion, and highlights from customer market research conducted to understand the financial lives and opportunities to offer digital financial services to vulnerable populations. The workshop enabled representatives from the public and private sector to work together to design a digital financial product based on market research findings. Attendees were enthusiastic about this and took into consideration the various elements needed to make a product or service a success—everything from regulation to marketing to the solution itself. This type of partnership is essential for holistic product design and market understanding because it incorporates all facets of the market for a common outcome and fosters deeper collaboration between key sectors of the industry. The benefits of increased collaboration to build inclusive digital financial services in Guatemala are manifold.

This starts with ensuring that everyone is able to easily obtain formal identification, which is managed by the government and typically required for opening a bank account or an online financial services account. According to a 2018 World Bank ID4D survey, 26 percent of the Guatemalan population aged 18+ do not have an identity card. It is up to the public sector to alleviate this simple barrier for access to financial services and products for many Guatemalans.

Second, the public and private sectors can help to increase financial literacy and awareness among the population. Many Guatemalans are still unfamiliar with the array of digital financial services available to them—from mobile money apps to accessing their online bank account—and may be understandably hesitant to adopt them. It is important that financial services be offered in Spanish and the 24 various indigenous languages to correct misconceptions. Government agencies and financial service providers can work together to develop educational campaigns and outreach programs that increase awareness and build trust.

Finally, collaboration between the public and private sectors can help to drive innovation. The private sector is better positioned to move quickly to respond to the unique needs of the Guatemalan market. This can include building new payment systems, digital lending platforms, and other services that increase access to financial services for everyone.

Collaboration between the public and private sectors in financial services can also be mutually beneficial. Increasing access to digital financial services in Guatemala will bring it in line with regional neighbors and enable financial service providers access to left-behind segments of the Guatemalan population. Ultimately, this work removes barriers to entry into the financial system, increases financial literacy, and drives innovation which serves Guatemalans.

Photo Credit: USAID By John Dorrett, Digital Finance Team, USAID

AFI Special Report • Blog: In times of crisis, Financial Inclusion with a focus on Women is not a distraction but actually a force- multiplier

Author:

Benedikt Wahler, Partner

Date:

June 16th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Crisis Response • Resilience Building • Research

In times of crisis, Financial Inclusion with a focus on Women is not a distraction but actually a force- multiplier – as highlighted by a new Special Report of the Alliance for Financial Inclusion (AFI) prepared by CCX. The COVID-19 pandemic has not just been a call to action but also a hotbed of innovation, testing and learning.

A new Special Report published by AFI, analyses the global set of experiences of financial sector policymakers, regulators and financial institutions, and provides recommendations: financial inclusion policy, particularly with a focus on Gender Inclusive Finance (GIF) leads to more effective policy response when a crisis is on as well as faster recovery and better resilience to future crises. In other words: a focus on women is the way to Build Back Better in the financial sector.

Gaps between women and men in the access to and usage of formal financial services, such as bank accounts, credit facilities, and insurance remain large and in a few regions were even growing. Before the COVID-19 pandemic, Gender Inclusive Finance (GIF), therefore, was a policy priority in many emerging markets. Already in 2016, the members of the Alliance for Finance Inclusion – central banks and financial regulatory institutions from 76 developing countries – committed to halving these gender gaps in the Denarau Action Plan. But a fast-moving crisis that disrupted social and economic life might seem to suggest such priorities have to wait.

With deep-dive research, extensive stakeholder interviews, a survey of one-third of AFI members and the financial inclusion policy and solution design expertise of our team, ConsumerCentriX (CCX) supported AFI to explore the nexus of women’s financial inclusion and crisis response in the project “Closing the Financial Inclusion Gender Gap During the Crisis and Afterward”.

The evidence from pioneering AFI member experiences is clear and borne out in macroeconomic data and numbers of active users of financial services. Without a focus on women as the largest group of at-risk, under-served citizens, crises linger, recovery is slower and less stable, and countries can catch a case of “economic long-COVID”.

AFI members like Paraguay, Fiji, Egypt, Bangladesh, Zimbabwe, Togo, Ghana, and Rwanda show that even under the pressures of crisis, Gender Inclusive Finance should be in focus. It helps set the right priorities, mobilise the most impactful set of stakeholders, identify the key operational challenges, and target beneficiaries with a large multiplier effect. Enabled by the opportunities of digital finance that can be ramped up fast even for poor countries that had so far seen limited adoption, GIF gets crisis relief and stimulus to where it is needed most and makes sure economic life can continue.

Some of the key recommendations for policymakers and financial services providers include:

Policymakers (central banks, regulators, supervisors)

- Support the development and use of digital financial services as an enabler and crisis-proofing of financial sector operations. Benchmarked against women’s needs and constraints, it will deliver the widest adoption – especially in areas likely the hardest to reach in times of crisis. For example, one of Africa’s poorer and smaller economies, Togo was able to launch payments to informal workers – many of them women -within 14 days and ramp it up to 1 in 5 adults.

- Make sure that new users who signed up during the crisis remain active users of formal (digital) financial services – and don’t revert to cash or informal practices. Women as financial managers of the household are key. Incentives, financial literacy, and consumer protection can help entrench these new practices of using financial services. What counts most are reliable, lost-cost everyday use cases: sending money to family and friends, paying for groceries – enable such ecosystems so that money that arrives from government support remains cashless.

Financial services providers (banks, MFIs, Fintechs, insurance companies)

- Building cashflow-based and digitally-enabled lending solutions ahead of a crisis makes the short-term liquidity support easier to deploy when crises hit. Women, as consistently better re-payers even in times of a global pandemic, are loyal clients, and as the financial managers of their households, they should be at the center of efforts to create these lending solutions. Using human-centred design that focuses on their needs and constraints is the approach to get it right.

- Partner with other organizations to promote financial inclusion for women, such as NGOs, government agencies, or business development skills providers where possible to enhance your reach among women. This can be done through providing non-financial services, such as business development training tailored to the needs of women entrepreneurs.

- Actively engage regulators in financial inclusion working groups to help shape Gender Inclusive Finance and be able to draw on established lines of communication and collaboration when crisis hits. This will lead to pragmatic and impactful policies.

In addition to the 5 case studies that are already published, ConsumerCentriX and the Alliance for Financial Inclusion will soon also share a policy toolkit to operationalize the recommendations from the special report. Stay tuned for more updates.

To access the report, visit: “Closing the Financial Inclusion Gender Gap During the Crisis and Afterwards” project special report.