Author:

Laura Trueba, Head of Latin America and the Caribbean

Date:

June 28th, 2024

Area Covered:

Latin America and the Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Gender-Inclusive Finance• Financial Regulation • Digital Financial Services

In the past two years, ConsumerCentriX (CCX) has undertaken important projects aimed at addressing barriers to financial inclusion in the Latin America and Caribbean (LAC) region. Drawing upon years of experience and more recent engagements, which included collaboration with Multilateral Development Banks (MDB), regulators and financial service providers (FSPs), CCX has an ecosystem-centric understanding of the financial inclusion landscape in the region. This approach has allowed us to identify and address the major challenges hindering greater financial inclusion in the region. To shed light on these major challenges, this blog will highlight some significant barriers.

Among the interventions that have empowered CCX to gain this valuable understanding include the Supply-side Sex-disaggregated Data Survey, commissioned by IDB Invest, reaching 13 LAC countries. This survey covered over 240 financial service providers in the region to understand their strategies for the women’s market, including mapping their financial and non-financial product offerings and their use of sex-disaggregated data. This resulted in a publication, “Women Rising“, highlighting, among many other insights, the untapped revenue potential in the women’s market, ranging from $1.87 billion in Mexico to $283 million in Guatemala.

Regarding the state of financial inclusion of women micro, small and medium businesses (WMSME), CCX has been recruited by IDB Invest to support the successful implementation of the Women Entrepreneur Finance Code (We-Fi Code) in the Dominican Republic. This will involve enhancing the capacity of the Asociación de Bancos Múltiples (ABA) as the local Aggregator and Coordinator, as well as FSPs, to fulfil the commitments of the Code.

On the regulatory side, CCX collaborated with the Alliance for Financial Inclusion (AFI) to develop a Gender-Inclusive Finance (GIF) Roadmap for AFI 11 member countries in the LAC region. This initiative aimed to systematically review practical policy actions to enhance women’s financial inclusion and reduce gender gaps. CCX also worked with AFI to conduct case studies of 13 countries, including eight from the LAC region, to understand the role regulators play in closing the financial inclusion gender gap.

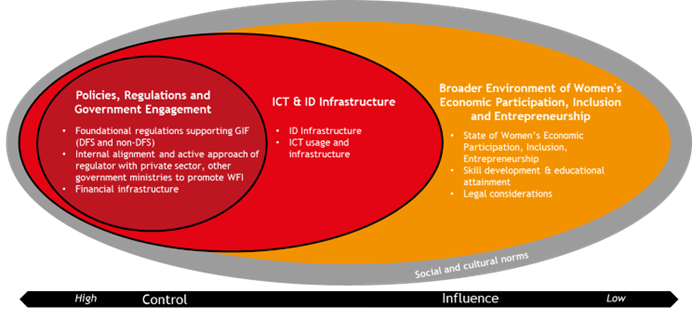

To conduct these case studies, an Analytical Framework for Inclusive Finance with a Gender Perspective was developed in partnership with AFI that comprises four key spheres that impact the state of financial inclusion in a country, such as 1) FSP’s actions towards women’s financial inclusion, 2) Policies, Regulations, and Government Engagement, 3) ICT and ID Infrastructure, and 4) the Broader Environment of Women’s Economic Participation, Inclusion, and Entrepreneurship.

Unveiling Financial Inclusion Disparities Between Rapidly Progressing and Slower Progressing Countries

- Delving into the regulatory landscape

Following our assessments and employing the AFI Framework for Inclusive Finance with a Gender Perspective as the analytical cornerstone, a significant disparity is observed between countries with limited financial inclusion and those that have made substantial progress. This disparity primarily revolves around the availability of financial infrastructure, the network of banking agents, their outreach, and utilization, which must also include mobile money/digital solutions services. Some developed regulations lack a digital financial services component, particularly concerning the interoperability of mobile banking, primarily within banking agents.

Interoperability, Open Banking, and National Financial Inclusion Policy in Perú

The Central Reserve Bank of Perú (BCRP) has been working on increasing interoperability to promote digital payments and financial technology and further drive financial inclusion. As of 2021, 44% of women and 55% of men reported making or receiving a digital payment to Global Findex, which is high for the region. To support the prevalence of digital payments, the BCRP has worked to strengthen retail interoperability, especially since the COVID-19 Pandemic. Today, over 100,000 retailers across the country are compatible with e-money. The BCRP has stated that payment providers must be interoperable, setting an implementation schedule for interoperability. The BCRP also runs the payment switch for interbank transfers, checks, ATMs, and mobile money, all integrated under the real-time gross settlement system.

Furthermore, we have observed that alongside mobile interoperability, there is a crucial need to ensure adequate regulation of mobile and digital financial services. Such regulation should permit electronic wallets for retail payments, facilitate the opening of e-wallets without mandatory linkage to a bank account, and enable digital customer identification (e-KYC) for individuals to open e-wallets or basic bank accounts remotely.

E-Wallets in El Salvador

E-wallets in El Salvador are driving financial inclusion, with uptake that is outpacing that of traditional bank accounts. In 2015, the country passed the Law to Facilitate Financial Inclusion; while the law spans many areas including tiered KYC, arguably its most important provision is the regulation of e-wallet providers and savings accounts with simplified requirements. The law imposes disclosure requirements, consumer protection standards, provides transaction limits for agent banking, and authorizes banks to issue their own mobile money services.

By paving the way for e-money and its use in the country, the law resulted in explosive growth of the MNO Millcom’s Tigo Money. Today, over 1 million Tigo Money accounts exist in El Salvador, representing about 20 percent of the adult population, which is immense compared to the 29% of women and 45% of men who own a bank account according to Findex 2021.[1]

More recently, in 2021, El Salvador’s government passed the Bitcoin Law and the roll-out of Chivo, a government-owned e-wallet for cryptocurrency and dollars. As of 2021, 3 million Salvadorians have downloaded the app and created an account, amounting to 46% of the population, 52 percent of which are women.

- Delving into the financial service provider landscape

According to the IDB Invest Supply-side Sex-disaggregated Data Research Survey, most FSPs in the region focus on the women’s market but still consider it part of their corporate social responsibility strategy. There is a clear knowledge gap on the business case and profitability of serving the women’s market, attributed to a lack of capacity to collect, use and analyze sex-disaggregated data. Moreover, without this data, FSPs are unable to develop holistic women’s market strategies, which are crucial for designing and marketing offers and products aimed at women clients.

While 75% of commercial banks in the region reported collecting sex-disaggregated data, over half (52%) continue to use manual reporting processes, which raises concerns about data quality, and most still have not established key performance indicators (KPIs). Furthermore, FSPs with advanced market strategies generally do not leverage the available data to evaluate return on investment or profitability.

As a result, they overlook clear business expansion opportunities, given their lack of emphasis on profitability as a reason for targeting the women’s market. By not thoroughly analyzing their existing data, FSPs may be missing a crucial business strategy for enhancing their focus on women.

Addressing financial inclusion barriers in the LAC region is crucial for socio-economic development. This requires collaborative efforts from regulators, FSPs, public entities, civil society organizations, and development partners. By continuing to innovate and adapt, CCX is paving the way for a more financially inclusive future.