Celebrating Women Entrepreneurs this March with the SME Response Clinic – Insights from Women Entrepreneurs and Leaders

A version of this article was originally posted on the SME Response Clinic

As we continue to celebrate March, the women’s history month, the SME Response Clinic is pleased to share with you a recap of some of the highlights from our engagements with women entrepreneurs and leaders in Rwanda over the past two years. Women entrepreneurs play a vital role in developing Rwanda’s entrepreneurship ecosystem and make a tremendous contribution to the nation’s economy. Join us in celebrating women entrepreneurs this month and throughout the year!

Here are some of the highlights:

Webinar on “Practical Solutions for Improving the Wellbeing of Women Entrepreneurs”

On 8 December 2021, the SME Response Clinic, in partnership with Geruka Healing Center, held a webinar featuring women entrepreneurs at the Kigali Public Library as part of the Building Back Healthier series. The webinar’s objective was to inform, inspire and share knowledge and skills that businesswomen can use to better their wellbeing as they deal with their day-to-day business activities while managing other responsibilities. The webinar featured a mental health expert, Adelite Mukamana and two businesswomen, Scovia Umutoni and Amina Umuhoza.

Interview with Her Excellency Dr Monique Nsanzabaganwa, former Deputy Governor of National Bank of Rwanda and current Deputy Chairperson of the African Union Commission

In July 2020, the SME Response Clinic interviewed Her Excellency Dr. Monique Nsanzabaganwa to understand the barriers women face in accessing information to help them better manage their businesses. During the interview, H.E. Dr. Monique emphasized the importance of not just making information available online but also mobilizing women to access that knowledge with a personal touch.

Watch the video to learn more

Learn about AMI’s Business Survival Bootcamp from Justine Ntaganda, owner of La Cornicle Hotel Rubavu and Nyabihu

Justine Ntanganda, a businesswoman who co-owns La Cornicle Hotel operating in Rubavu and Nyabihu districts, attended a Business Survival Bootcamp training organized by the SME Response Clinic in partnership with the African Management Institute. Ms. Ntanganda shared with the SME Response Clinic more about what she learned.

Watch the video to learn more

To learn more about AMI training offers in Rwanda, visit: Africa Management Institute

Celebrating Women's Entrepreneurship in Rwanda

Celebrating Women’s Entrepreneurship in Rwanda

A version of this article was originally posted on the SME Response Clinic

Women entrepreneurs represent the fastest-growing segment of entrepreneurs globally, and Rwanda is no exception. According to the 2020 FinScope Gender Report, women lead about 52% of micro, small, and medium enterprises (MSMEs) in Rwanda (or about 420,0000 businesses). Through these businesses, women entrepreneurs are significant contributors to GDP growth and create jobs critical to people’s livelihoods in their communities and the country at large.

At the SME Response Clinic, we value women entrepreneurs’ role in Rwanda’s economic and social development. Since our launch in May 2020, we have developed content, hosted webinars, and conducted targeted marketing activities to better reach women entrepreneurs and support them in business growth despite tough times.

This month, we will focus our efforts on celebrating the role played by women entrepreneurs in developing the entrepreneurship ecosystem in Rwanda. We will highlight some of the exceptional women entrepreneurs we have encountered so you can learn from their experiences or maybe find a new business to try out!

Join us this month as we celebrate – and reach out to us to share the name of a women-led business you know and love at musa.kacheche@consumercentrix.ch!

How Fintechs Can Capture the Female Economy

Women represent the world’s largest and fastest growing financial market. They are expected to control more than $216 trillion in wealth.[1] They are also strong savers, loyal and reliable customers and better credit risks than men.[2] Yet, women are often excluded from formal financial services. Only 65% of women have a bank account, compared with 72% of men, and this gender gap is 3 times larger when it comes to use of fintechs.

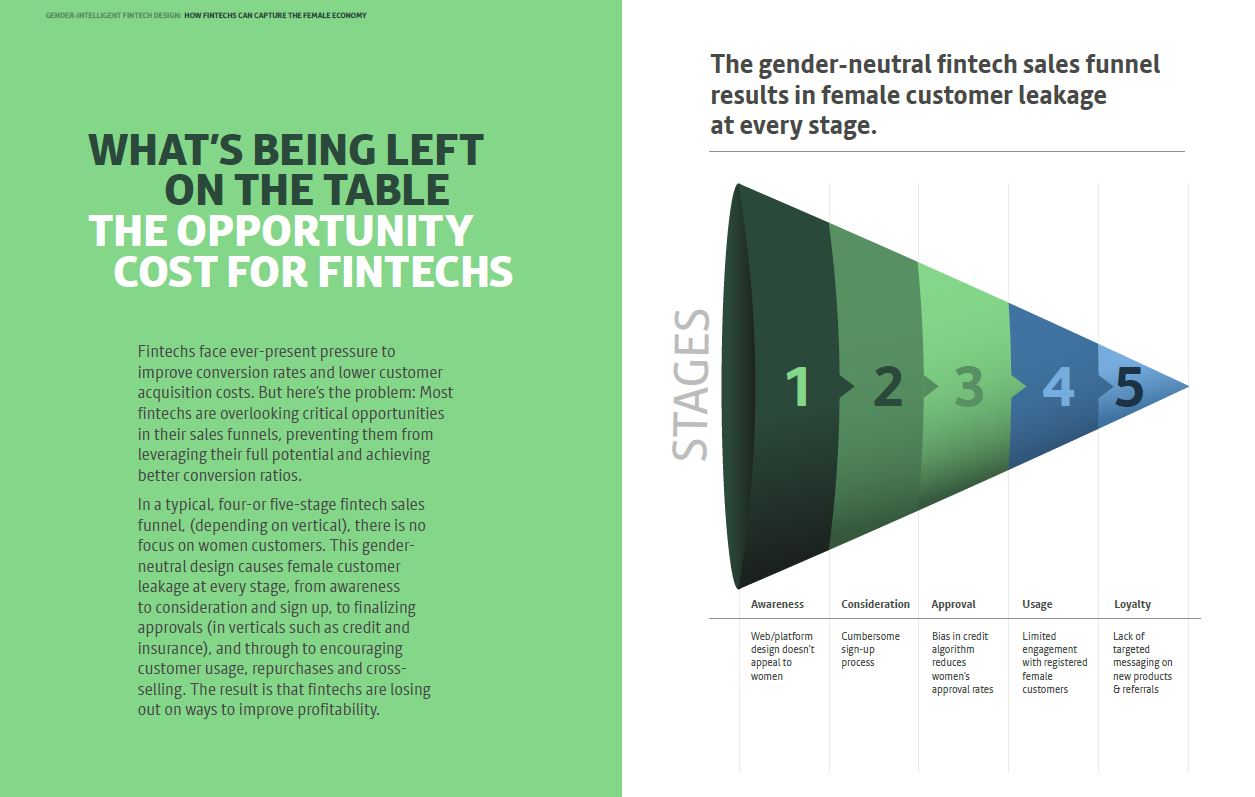

While fintechs have transformed the financial landscape recently and are uniquely positioned to close this gender gap, many fintechs are overlooking the women’s market. To help fintechs embrace this opportunity, ConsumerCentriX conducted research for a study called “How Fintechs Can Capture the Female Economy” commissioned by the Financial Alliance for Women. The report lays out a map that fintechs can use to improve their conversion rates for women within each stage of the sales funnel. By addressing the unmet needs and barriers that women face in accessing the financial market, fintechs can attract and retain more women customers, reduce customer acquisition costs, and boost revenues.

Although women are generally drawn to digital financial services, there are particular drop-off points in their uptake at different stages of the sales funnel. For instance, fintechs that use tailored marketing messaging to reflect women’s needs will attract more women to their platforms as opposed to one-size-fits-all messaging. If the signup procedure is lengthy or the language is convoluted then fewer women will sign up for the service. Unconscious algorithmic bias can affect how many women get approved for loans. Once women are signed up and approved, their product usage needs to be nurtured.

Fintechs can make significant business gains by developing an intentional focus on women throughout the stages of the sales funnel. Here’s how:

- Most fintechs apply a gender-neutral approach to their marketing campaigns that doesn’t account for women’s behaviors and their differing realities. Fintechs should create gender-differentiated marketing campaigns that appeal to women and motivate them to click through the website. Our research found that by attracting as many women as men to their site, fintechs could see up to a 12% increase in revenue.

- Fintechs typically face high drop-off rates before sign up, in all verticals and across all customer segments. Many women customers drop off because the registration process is time-consuming and cumbersome. Fintechs should focus on creating a user-friendly process and demonstrating product value. Our research found that by converting women at the same rate as men, revenue could increase by 70%.

- Women customers are denied approval more often than men because the underwriting algorithms are embedded with unconscious bias. Fintechs should create a qualifying stage in the sales funnel for products such as credit and insurance and exclude qualifying criteria in which women are structurally disadvantaged but have no bearing on their performance as customers, like type of employment or education. Our research found that by removing bias in the credit algorithm, lending fintechs could increase gross margins by 20%.

- When women customers have signed up, the goal is to encourage activity by creating a sense of community and promoting organic marketing with user-generated content. Our research found that by actively engaging with registered female customers, monthly revenue could increase by 15%.

- Satisfied women customers are more loyal than men, have higher net promoter scores and will purchase more in cross-sales than men. By leveraging the positive experiences of women customers and tapping into the power of female referrals, fintechs can accelerate their organic customer growth by 50%.

While many fintechs have failed to design products that reach the women’s market, there are exceptions like Kubo Financiero, a fintech that provides loans and savings products across Mexico. Kubo posts financial education content on their Facebook and WhatsApp groups that targets their women customers and promotes personal interaction with their customer service agents by making them easily accessible through WhatsApp texting or video calls. Additionally, the company discovered a significantly higher drop-off rate during the registration process for women compared to their male peers. By paying attention to their data, they were able to increase the female customer signup rate by 14% through redesigning a more user-friendly registration page and revising the language.

“If you have healthy finances, it’s super easy to activate your credit [with Kubo Financiero].”

Lisa, a Kubo customer, needed capital to fund her daughter’s education but was looking for more than a loan from her bank and wanted access to financial education information as well. She regularly engages with Kubo’s WhatsApp groups to gain insights on her financial health. Lisa recommended using Kubo because it’s more accessible, informative and effective for her.

What’s next: Fintech investors are still in the early stages of assessing an investment with a gender-lens and many indicated that they need more evidence for the business case. This research clearly shows the value of focusing on women customers through gender-intelligent fintech design. Addressing the unmet needs of women is a win-win situation. By applying a gender lens and asking the right questions, investors and fintechs alike can capture the female economy, improving their revenue and profitability while advancing women’s financial inclusion.

Gender Equality and Women’s Economic Empowerment Mapping Tool: Spotlighting Opportunities for Impact in Sub-Saharan Africa

Sub-Saharan Africa is the only region in the world where women make up the majority of entrepreneurs. But, delve a little deeper and you will find that women face steep social and economic barriers to growing their businesses. While access to finance is the key constraint, they are also much more likely to be hindered due to household responsibilities and are less likely to have the market skills to advance their businesses. Removing these barriers could unleash a huge opportunity for women entrepreneurs and boost economic growth in the region.

The European Investment Bank (or EIB) launched the African Women Rising Initiative (AWRI) to support women’s economic empowerment in Sub-Saharan Africa by identifying effective environments for growth, increasing access to finance, and supporting women entrepreneurs in selected countries. The AWRI aims to strengthen women-led or -owned businesses through designing holistic, market-oriented programs, bolstering business skills, and developing gender intelligent financial services.

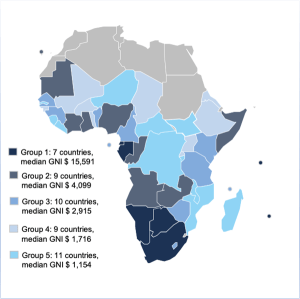

As a first step for the AWRI, ConsumerCentriX (CCX), as part of the Consortium with German-based technical advisory group IPC and African Management Institute (AMI), set out to identify the strongest opportunities for impacting women entrepreneurs in Africa. CCX conducted a comprehensive mapping exercise that assessed the current state of financial inclusion for women, women’s entrepreneurship and empowerment initiatives, as well as innovations in financial technology, and digital banking. Based on this exercise, the team identified countries in the region that have substantial gaps in gender equality and women’s economic empowerment, however, their macro and social environments could enable a financial sector intervention that fosters progress.

Mapping Methodology

Women entrepreneurs are not evenly distributed across Sub-Saharan Africa. The region is made up of 48 countries at varying stages of development and some places offer a more conducive environment for women entrepreneurs to grow their businesses with the support of formal financial services. In order to better understand women’s financial and economic inclusion opportunities, we created a scoring system based on 65 publicly available indicators from sources such as the Global Findex[1]. Not all countries in Sub-Saharan Africa were surveyed by the Findex which limited the comparable data, but in many cases, other indicators were able to be substituted from other sources like the World Bank, International Monetary Fund, the Organization for Economic Co-operation and Development, Economist Intelligence Unit, as well as Citibank and Mastercard data that illustrate macroeconomic, demographic, political-regulatory, and socioeconomic dynamics within each country. Additional sector-specific datasets contributed a broader understanding of the stage of development and inclusiveness of the financial sector. We then ranked each country according to their stage of development as indicated by the gross national income (GNI) per capita and compared them based on the indicators.

The indicators were categorized into four overarching themes that tested each country’s receptivity to potential financial inclusion efforts based on their legal or socio-cultural constraints and women’s access to finance. The categories included:

- Enabling Environment: Provided a snapshot of each country’s development stage by assessing the general economic and demographic environment through indicators like conflict, debt, GNI per capita and GDP, and population characteristics;

- Women’s Inclusion and Human Capital: Assessed women’s socio-economic position including factors that influence their productivity and opportunity to build capital;

- Women’s Entrepreneurship: Analyzed the ease of doing business in each country and women’s typical role within the small and medium-sized enterprise (SME) sector; and

- Financial Sector: Focused on the availability of financial services through different channels, the regulatory environment, and the sector’s inclusivity and capacity to serve entrepreneurs with financing.

Ultimately, the CCX team created an effective tool that swiftly facilitates benchmarking of countries in Africa (and beyond) for our work on impact consulting in women’s financial inclusion and entrepreneurship support. Additionally, the tool includes permanent links to the respective databases utilized for the mapping exercise.

Results

During the mapping exercise, 19 countries were immediately omitted from the selection process based on insurmountable obstacles to a long-term technical assistance engagement like extensive violent conflict and significant debt distress. Countries with extremely small populations were also not carried onto the shortlist due to their lack of scalability and potential impact.

In order to narrow the playing field even further, we categorized countries in Sub-Saharan Africa into five groups based on their development stage. Each country was ranked according to threshold criteria against peer countries within each group. Countries were excluded from consideration if the socio-economic challenges or gender gaps they were facing could not be realistically addressed with financial inclusion or women’s economic empowerment initiatives. To advance to the next round, countries needed to score 60-70% on average across all indicators when compared to the top country within each group.

Countries that met the threshold had significant room for improvement in women’s entrepreneurship and inclusivity in the formal financial sector that could be addressed by the areas intended for the AWRI technical assistance, namely empowering women entrepreneurs and creating gender-intelligent and innovative SME financing solutions. In other words: these countries indicated a substantial potential for growth compared to their best-in-class African peers, while also presenting a sufficiently conducive environment for impact through the AWRI support.

Based on this scoring system, a shortlist of 16 countries qualified including Benin, Burkina Faso, Democratic Republic of Congo, Cameroon, Côte d’Ivoire, Ghana, Kenya, Lesotho, Liberia, Madagascar, Mozambique, Nigeria, Rwanda, Senegal, and Uganda.

EIB selected Côte d’Ivoire, Rwanda, Senegal, and Uganda were selected as the four finalists. These countries have healthy percentages of SMEs t

hat are women-led or -owned, have financial institutions with existing relationships with EIB that are interested in better serving women entrepreneurs, show strong potential for growth with existing conducive regulatory and social environments and/or the opportunity to leverage digital channels to deepen financial inclusion and women’s economic empowerment.

Below is brief overview of the four finalist countries:

- Côte d’Ivoire is the business hub of French-speaking West Africa with strong prevalence of private business and self-employment with an established financial sector, fast-growing microfinance activity and strong digital uptake;

- Rwanda has high women’s labor force participation (84%) and a supportive public sector, a national financial inclusion strategy and investment climate which offers strong opportunities for digitization;

- Senegal is a majority Muslim country that has a relatively high degree of gender equality in early-stage entrepreneurship, with a high share of female entrepreneurship and strong remittances which could serve as a source of funding for women business owners; and

- Uganda is an attractive market for business investment given its stable economy, large market, and the size of its labor force with a financial inclusion strategy that is generally supportive of women’s economic activities.

The mapping exercise was successful in identifying countries in the region that are more favorable to women’s economic inclusion and empowerment and serves as a useful tool for understanding country contexts in the financial sector in other regions throughout the world.

Women in Sub-Saharan Africa face universal constraints as entrepreneurs and EIB’s AWRI program will now support organizations that can increase women’s financial inclusion by developing quality programs involving access to finance, training and other non-financial services to support woman entrepreneurs’ growth.

[1] The Global Findex is a publicly available data set on how adults save, borrow, make payments and manage risk that is published every three years by the World Bank. Data is collected in partnership with over 140 economies through nationally representative surveys.

ConsumerCentriX launches Compassionate Leadership for Entrepreneurs to support wellbeing of small business owners

ConsumerCentriX is launching Compassionate Leadership for Entrepreneurs to support small business owners as they navigate uncertain times. The COVID-19 pandemic has had a disorienting effect on global health, economic activity, and our daily lives both professionally and personally. Business owners and entrepreneurs have been among those most affected by COVID-19 as lockdowns and border closures made it nearly impossible for them to continue their day-to-day operations. As small business owners work to recover from the effects of the pandemic, personal wellbeing should be a priority, as it affects decision-making, employee management, and ultimately a business’ bottom line.

Compassionate Leadership for Entrepreneurs will feature a series of informative blogs, webinars, and a local radio show that explore tools and tips for business owners to positively impact their wellbeing. The initiative draws on the concept of compassionate leadership, which is defined as interacting as a leader in ways that exhibit compassion for oneself and in relationship to others as well as acting intentionally to create positive impact in the world as a whole.[1] The first of three webinars in the Compassionate Leadership Public Engagement Series launches on November 4th, 2021 in partnership with Stanbic Bank Uganda Limited. In Rwanda, the Building Back Healthier Series launched with a local radio show held October 25. Two additional webinars are scheduled to take place this fall, the next in mid-November.

In tough business environments, leading with compassion takes courage and is rewarded with resilience. Compassionate Leadership for Entrepreneurs will take a deep dive into the positive impact of compassionate leadership and the importance of focusing on personal wellbeing. Stay tuned as we share strategies and tools to help entrepreneurs foster better work environments, build better business outcomes, and lead with compassion.

[1] Center for Compassionate Leadership. July 9, 2019. “What is Compassionate Leadership?”

ConsumerCentriX and Stanbic Bank Uganda Limited to Launch Compassionate Leadership Series on 4th November 2021

In partnership with ConsumerCentriX, Stanbic Bank is pleased to have the opportunity to introduce the Compassionate Leadership Public Engagement Series.

The Series will consist of three webinars featuring compassionate leaders and technical persons in our community, that will help us understand how they have effectively led their organizations and provide practical tools in overcoming the challenges brought by the pandemic.

The inaugural conversation, Leading with Heart – “adapting to a new normal in a tough business environment”, will be launched on 4th November 2021 at 2 pm and will be moderated by Maurice Mugisha, with Anne Juuko, Stanbic Bank CE, Wim Vanhelleputte, Chief Executive MTN (U) LTD, and Thadeus Musoke Nagenda, Ag. Chairman KACITA, as panellists.

Don’t miss the opportunity to participate!

To register for the webinar, visit: Webinar Registration

Strategies that can help save your business and plan for the unexpected

A version of this article was originally posted on the Covid-19 Business Info Hub

Due to the pandemic, many businesses have experienced new and significant operational challenges such as inadequate cash flow, decreased demand, and supply chain disruptions resulting from lockdown restrictions. According to the Economic Policy Research Center (EPRC), 50% of businesses in Uganda had to close operations at least temporarily for an average of over three months. These challenges were unprecedented and have made it clear how disruptive a crisis can be. Most companies were unprepared and as a result, some have closed operations permanently. Others have struggled to get back on their feet.

Here is where a business continuity plan can be a critical tool enabling businesses not only to survive but potentially to thrive even during a crisis. A business continuity plan is a document that outlines how a business will continue operating during an unplanned disruption. It guides businesses on how to reassign resources and communicate effectively internally and externally, all key components to maintain operations even during challenging times.

Because developing a business continuity plan may be a new concept for small business owners, in September, the COVID-19 Business Information Hub focused on guiding entrepreneurs in their development. We had insightful discussions with stakeholders and businesses who implemented a variety of business continuity strategies during the pandemic, and here is what we learnt:

Conducting a risk assessment: The first thing that every business owner should do is assess the risk and vulnerability of their business. This can be easily done using a tool that the International Labor Organization (ILO) provides free of charge. The ILO also outlines a six-step process to develop the business continuity plan with a key focus on four main elements (People, Process, Profits, and Partnerships). We spoke with John Kakungulu Walugembe of Federation of Small and Medium-Sized Enterprises-Uganda (FSME), who explained in detail what the 4Ps stand for and how businesses can use the six-step plan to their advantage. (click here to access the special interview with John Walugumbe).

Determining critical activities: Business owners need to define critical activities needed to continue to operate during a crisis. Businesses should immediately identify actions to take based on the risk exposure. Lilian Katiso of Mau and More, a company that sells potted plants, recognized that watering plants was critical to mitigate the risk of losing her inventory due to withering. The business decided to purchase a motorcycle to facilitate one staff to do the watering during the lockdown.

Establishing an internal communication plan: A communication plan outlines how teams and employees may best communicate with each other to support the company’s objectives. It helps increase communication frequency and promotes the dissemination of information about what is happening within the company and the employees. Toddler’s Gold implemented a communications plan including regular meetings to discuss business targets and understand staff welfare. As a result, their sales grew during the lockdown.

Embracing technology and digital platforms: Technology helps to support business operations during challenging times. When regular work arrangements were disrupted, and we saw a shift to remote work, Rajab Mukasa, Director at Pique Nique Ltd, adopted mobile money and the use of agents to complete his banking activities. It allowed the company to order by phone and pay suppliers remotely instead of using cash.

The disruptions caused by COVID-19 have set a new preparedness benchmark and demonstrated that small businesses need to continuously adapt and evolve their strategies to better prepare for future risks. Joseph Walusimbi a national coach and trainer with the International Trade Center (ITC), an agency of the United Nations, encourages entrepreneurs to embrace business continuity plans to prepare for uncertainty. He also highlighted the potential need for external financing to implement specific activities. Businesses should seek financing options focusing on recovery, innovation, adaptation and sustainability, such as the Economic Enterprise Restart Fund available at Stanbic Bank Uganda or credit guarantee schemes that shift risk from the private to the public sector.

The SME Response Clinic Partners with KCB Bank

The SME Response Clinic Partners with KCB Bank

A version of this article was originally posted on the SME Response Clinic

The SME Response Clinic has partnered with KCB Bank Rwanda as part of our ongoing efforts to bring entrepreneurs even closer to financial institutions that offer access to finance and non-financial services to meet business needs through COVID-19 and beyond.

Through this partnership, entrepreneurs will have access to timely information on KCB Bank’s financial products as well as non-financial services such as KCB Bank’s Biashara Club, which features preferential offerings, trainings, business workshops, and networking opportunities. Through the partnership, SME Response Clinic visitors will also have a direct line to the institution at +250788140000.

We are excited about the opportunities this partnership can create for your businesses, and we look forward to providing you with regular updates on KCB Bank Rwanda’s products and services!

ConsumerCentriX best-in-class training to support financial institutions serving the SME segment goes virtual

ConsumerCentriX best-in-class training to support financial institutions serving the SME segment goes virtual

ConsumerCentriX has a long history of working to support financial institutions serving small- and medium-enterprises (SMEs).

SMEs face a tremendous financing gap, and many do not have access to the kinds of business development services that make them stronger potential borrowers with the skills to grow their businesses as usual or to manage disruptions like COVID-19. SMEs face unique challenges and have specific needs.

On the other hand, financial institutions have a hard time grappling with understanding the full financial picture of many businesses in this segment, and as a result, find it challenging to lend to SME entrepreneurs, whose recordkeeping varies and who may bank with multiple banks (or none at all).

The financial institutions that serve SMEs – both those who want to serve them for the first time and those who want to serve them better – need to consider implementing an approach that enables them to better understand their SME customers: a relationship management approach. This approach entails establishing and maintaining long-term relationship with customers centered around providing solutions that meet customer needs rather than just promoting one product or service. In turn, this ensures a greater share of wallet for the bank.

Effective relationship management in SME banking requires strong Relationship Managers with skills in connecting with customers and understanding how to analyze businesses in this unique segment as well as in monitoring post-disbursement to address potential issues before they arise or to identify additional needs customers may have. Earlier this year, ConsumerCentriX developed and launched a four-part virtual training program to support Relationship Managers in honing their skills to better serve the SME segment. The best-in-class curriculum centers around four key areas essential to serving SMEs:

Relationship Management

Provides trainees with foundational skills needed to build a relationship with customers and real-life examples to complement learnings

Gender Awareness

Identifies and addresses potential biases trainees may have in approaching or assessing women entrepreneurs

Business and Credit Analysis

Focuses on techniques to collect, cross-check, and analyze business information to conduct an efficient credit analysis using quantitative and qualitative information

Decision Formalization and Portfolio Management

Hones trainees’ technical skills in preparing credit proposals, including identifying potential risks and mitigation strategies that are monitored from loan origination throughout the repayment period.

ConsumerCentriX transformed these topics, normally covered in 8 days of in-person classroom training, into 4 online modules with 26 mini-sessions of between 20 and 45 minutes. The mini-sessions include animations, exercises, and videos that aim to bring life to self-paced virtual learning.

We recently piloted the training with Stanbic Bank Uganda Limited (SBU), one of the largest commercial banks in Uganda with a strong footprint among SMEs that aims to expand its reach and deepen its engagement in the sector.

What have we learned?

While the pilot is still underway, ConsumerCentriX is already seeing results and has been able to leverage preliminary learnings to make small tweaks to enhance the effectiveness of the virtual training.

Importantly, trainees are successfully learning the theoretical knowledge presented in the self-paced virtual sessions. While online learning has become frequent due to COVID-19, the sessions developed for this training are short and as interactive as possible to avoid some of the fatigue that has become common with participating in online events.

Pearl Akol, an Enterprise Direct Business Banker at SBU, shared that as a result of completing the relationship management component of the online training, she has “understood that you have to listen to the customer carefully and match a solution to the customer’s need” rather than to focus on selling a particular product. It transforms the way she approaches conversations with new and existing customers and is sure to have an impact on the bank’s bottom line. For Alex Insingoma, an Enterprise Direct Business Banker, the gender awareness module was eye-opening. “After going through this training, I was able to recognize the importance of women in business given their big numbers and their unique way of running businesses,” he said.

While theoretical knowledge can be effectively transmitted through self-paced virtual sessions, live online discussions and practice sessions best ensure information is internalized by trainees. Typically, ConsumerCentriX follows up our in-person SME training programs with hands-on coaching and mentoring done with trainees at their branches and in the field. This kind of approach can be difficult to replicate online, but other techniques can be used instead. We incorporated live virtual coaching sessions moderated by our expert SME team to smaller groups of 5-7 people for 1.5 hours at a time. They focus on addressing main challenges faced by participants on any of the content, provide a dedicated time for trainees to practice specific tools or skills acquired, and offer participants the opportunity to discuss real case studies from actual entrepreneurs.

Lastly, proper planning and oversight by the financial institution are critical to success. ConsumerCentriX usually conducts multiple planning meetings in advance of in-person training to outline the objectives, ensure staff availability, and to identify how outcomes will be tracked in close collaboration with the partner financial institution. These steps cannot be skipped for virtual learning.

- First, an institution needs to identify its goals – particularly the behavior changes and outcomes that it aims to see as a result of the training.

- Then, time needs to be set aside for staff to complete the training – this can be a number of hours per day or week within a certain period of time. This needs to be communicated to staff, and follow-ups should be conducted by managers to ensure staff are completing modules within designated deadlines.

- Finally, the institution needs to identify the key performance indicators it will track to understand outcomes – if a financial institution wants to see additional business generated as a result of the training, key performance indicators around new leads or a greater share of wallet should be clearly communicated at the start of training, monitored during training, and tracked over time once training is completed.

ConsumerCentriX looks forward to completing the pilot training with SBU over the next few months and partnering with other financial institutions across Sub-Saharan Africa and beyond to continue to serve SMEs despite challenging times. If you are interested in learning more or partnering with us, contact info@consumercentrix.ch.

.

Developing a Business Continuity Plan for Your Enterprise

ConsumerCentriX works closely with Stanbic Bank Uganda on both the COVID-19 Business Info Hub and the Stanbic Business Incubator. This article originally appeared on the COVID-19 Business Info Hub.

The COVID-19 Business Info Hub spoke with John Kakungulu Walugembe of the Federation of Small and Medium-Sized Enterprises-Uganda (FSME) to understand the importance of developing a business continuity plan for enterprises and how this helps to build resilience during challenging times. A business continuity plan can be defined as a document that outlines how a business will continue operating during an unplanned disruption in service. It contains contingencies for business processes, assets, human resources, and business partners – every aspect of the business that might be affected.

John K. Walugembe is the Executive Director of FSME, the umbrella/business association that brings together over 112,000 micro, small and medium-sized enterprises across 20 sectors in the country. Here’s what John had to say about the importance of business continuity plans in light of circumstances brought about by disruptions like the pandemic:

“Many businesses don’t have business continuity plans and do not know why they need to develop them.”

The impact of the pandemic on the MSME sector is unprecedented. Many businesses are closed, others have limited demand, and many are struggling to pay their staff. Businesses face challenges they have never encountered before and disruptions at overwhelming levels. So, “when we are talking about business recovery and resilience, we are trying to ensure that businesses get back to their pre-pandemic level” of operations. Business continuity plans can help businesses in doing just that. However, many entrepreneurs do not know what they are or how to go about putting them together.

FSME worked with International Labor Organization (ILO) to assist 200 MSMEs to come up with a business continuity plan according to a six-step process developed by the ILO.

FSME used the ILO’s six-step process for putting together a business continuity plan, which starts with an assessment of risk.

To assess the level of risk and vulnerability faced by a company, business owners need to focus on the 4Ps below and can assess their level of risk using the link included above.

People

How are your workers and their families affected by COVID-19?

Processes

How are the everyday operations of your business affected?

Profits

To what extent is your income and revenue affected?

Partnerships

How is the environment around your business affected by COVID?

Next, businesses must follow six steps as outlined below.

Step 1: Identify your key products or services.

Step 2: Establish the objective of your plan.

Step 3: Evaluate the potential impact of disruptions on your enterprise and workers.

Step 4: List actions to protect/minimize risks to your business

Step 5: Establish contact lists for non-physical activities (WhatsApp calls, Zoom meetings etc.).

Step 6: Maintain, review, and continuously update your plan.

“SMEs should also network and reach out for help.”

Although business continuity plans help answer questions about how your business can continue operations in moments of crisis, companies need to be agile and adapt plans to changing circumstances. One way to do this is by reaching out for support from organizations like FSME and to other business development service providers. Businesses can also reach out to their networks for ideas and support.

FSME is keen to support SMEs when and where possible, so please reach out to the organization via Tel at 0774147864 or via email at info@fsmeuganda.org or at john.walugembe@fsmeuganda.org