ConsumerCentriX attends Nigeria's 2024 International Financial Inclusion Conference.

ConsumerCentriX participated in Nigeria’s 2024 International Financial Inclusion Conference (#IFIC2024), organized by the Central Bank of Nigeria, which took place on November 12-13 at the Landmark Event Centre in Lagos. This year’s conference theme, “Inclusive Growth: Harnessing Financial Inclusion for Economic Development,” brought together over 2,000 participants from 78 countries, including global thought leaders, industry practitioners, and influential stakeholders

The conference agenda featured dynamic plenaries, roundtables, and exhibitions showcasing innovations that advance financial access and address critical topics such as gender-inclusive finance, MSME financing, and digital financial solutions.

As a key contributor to the event, Anna Gincherman, Partner at ConsumerCentriX, spoke in the session “Powering Nigeria’s Inclusive Growth through MSMEs.” Drawing on ConsumerCentriX’s global expertise, Anna highlighted the importance of leveraging data to build effective financial solutions for micro, small, and medium-sized enterprises (MSMEs), focusing on women-led businesses.

Beyond Anna’s session, ConsumerCentriX celebrated significant milestones during the week:

- Launching the Women’s Financial Inclusion Dashboard: Together with the Central Bank of Nigeria and the Nigeria Inter-Bank Settlement System PLC (NIBSS), ConsumerCentriX unveiled the Women’s Financial Inclusion Dashboard. This innovative data portal offers granular, up-to-date information on access and usage of financial services in Nigeria. Work is now underway to expand the portal with sex-disaggregated SME data, expected by the end of November. Visit the dashboard at www.wfid.ng.

- Onboarding Signatories to the WE Finance Code: Following the launch of the Women Entrepreneurs Finance Code (WE Finance Code), ConsumerCentriX, in collaboration with the Central Bank of Nigeria and the World Bank, co-led a workshop to onboard more than 30 signatories of the WE Finance Code, including 12 leading banks. This initiative emphasized the responsibilities and benefits of joining the Code, including capacity-building opportunities and peer learning programs presented by the Financial Alliance for Women.

- Collaborative Dialogues: ConsumerCentriX contributed to rich discussions during #IFIC2024, sharing insights on leveraging data to create impactful SME solutions. The event provided an opportunity to reconnect with colleagues and industry pioneers who continue to drive digital financial inclusion and innovation in Nigeria.

ConsumerCentriX is committed to fostering inclusive growth and supporting initiatives empowering MSMEs and underserved segments including, WMSMEs globally.

Developing a Global Segmentation Framework and Toolkit for Women-Led/Owned SMEs.

Facilitating greater capital flow to women-led businesses is crucial for fostering economic growth and empowerment. Despite increasing awareness of the gaps women SMEs (WSMEs) face in access to capital and banking, the supply-side response has not been intentional in targeting segments of WSMEs with unique products and services and altering their processes to serve them better. While the social and economic benefits are clear, policy and private sector priorities have not consistently aligned around supporting WSMEs in an effective manner. ConsumerCentriX, with the support of the Women Entrepreneurs Finance Initiative (We-Fi), Argidius Foundation, and the Dutch Good Growth Fund (Triple Jump), is developing a WSME Segmentation Framework and Toolkit to address this gap. The framework and toolkit aim to transform how financial sector stakeholders understand and serve women entrepreneurs and business owners.

Current market segmentation practices for WSMEs are largely supply-driven, focusing primarily on business size and gender split. This narrow approach of segmenting SME markets by business size and overlaying a definition of women enterprises fails to address the critical dimensions that define her and her business. Financial sector stakeholders need a nuanced segmentation to tailor their support and services in a way that effectively supports different profiles of WSMEs to grow.

Based on primary findings from literature reviews and stakeholder interviews conducted in phase one of the project, it became evident that existing frameworks are insufficient at addressing the unique circumstances of women SMEs. While some frameworks include personal and psychological dimensions, none offer a comprehensive view that provides for critical factors like household responsibilities and dependents. This highlighted the need for a new, holistic approach that considers the full spectrum of influences on women entrepreneurs, including the environment in which she operate and how supportive or restrictive elements like social and gender norms and legislation are.

The WSME Segmentation Framework and Toolkit developed through this project leverages a gender-inclusive approach to segmenting WSMEs: by beginning with her as an entrepreneur or business owner, separating her from her business, and placing her and her business in the environment where she operates. These factors determine the growth path that her business is on, whether low/no growth, steady growth, or high growth/venture.

Through quantitative and qualitative research with WSMEs in Pakistan, Uganda, and Colombia, CCX will be able to determine which factors about her as a person, her business and the enabling environment are deemed the strongest determinants of which growth path she ends up on. From there, CCX will define segments and profiles using the factors. Marrying that insight with learnings from research on the supply-side, the final Global Segmentation Framework will illustrate not only the descriptors/dynamics and financial/non-financial needs per segment but also the supply-side response to target each segment and where the gaps are.

Ultimately, the goal of the WSME Global Segmentation Framework and Toolkit is to provide financial sector stakeholders with the tools and insights needed to offer more targeted and practical support to women entrepreneurs.

ConsumerCentriX Participates in and Co-organizes Two-Day Workshop on WE Finance Code in Georgia

ConsumerCentriX (CCX) had the privilege of co-organizing a two-day workshop in partnership with the European Bank for Reconstruction and Development (EBRD) and the National Bank of Georgia (NBG). The workshop focused on advancing financial inclusion for women-led enterprises in Georgia, an important step towards improving access to finance for Women-Owned Small and Medium Enterprises (WSMEs).

Day 1: Leveraging Data for Advancing Finance to Women Entrepreneurs

The first day began with a comprehensive analysis of Georgia’s WSME Finance Landscape. High-level representatives from the private sector and key ecosystem stakeholders attended the session, which opened with welcoming remarks by Ms. Natia Turnava, Acting Governor of NBG, and Mr. Alkis Vryenios Drakinos, Regional Head of Caucasus at EBRD.

Anna Gincherman from CCX set the stage by providing an insightful overview of international developments in gender-disaggregated data. She highlighted the business case for collecting and analyzing this data, revealing that while women-owned enterprises constitute around 32% of all SMEs in Georgia, they account for only 7.5% of formal credit access. This gap underscores the importance of developing targeted financial solutions for women entrepreneurs.

David Taylor of CCX followed by introducing the WSME Dashboard (https://www.wefinancegeorgia.ge/), an analytical and data visualization tool designed to provide insights into the financial landscape for WSMEs. The Dashboard sparked lively discussions among participants, who explored its potential applications for their own institutions.

Later in the day, Ms. Aurica Balmus, Principal of Gender and Economic Inclusion at EBRD, gave an in-depth presentation on the WE Finance Code and its potential impact on Georgia’s financial sector, particularly in improving access to finance for women-led businesses.

The session concluded with a presentation by Mr. David Utiashvili, Head of the Financial Stability Department at NBG. Mr. Utiashvili shared the regulator’s vision for the future of the WSME Dashboard, calling for collaboration between financial service providers (FSPs) and other stakeholders to enhance its capabilities. His remarks emphasized the need for collective efforts to ensure that the Dashboard becomes a valuable tool for increasing financial inclusion for WSMEs in Georgia.

Day 2: WE Finance Code – Data-Driven Strategies for Financing Women-Led Enterprises

The second day took a more interactive approach, with participants from financial institutions, including data, product, and ESG managers, as well as representatives from the Georgian Bankers Association. The discussion centered on their experiences working with the WSME segment and sex-disaggregated data.

Istvan Szepesy and Anna Gincherman from CCX led the morning session, focusing on strategies for capturing and managing gender data. They encouraged participants to critically assess their current data collection and analysis methods and offered practical recommendations for improvement.

David Taylor returned to share emerging insights from the WSME Dashboard, illustrating how the tool can inform data-driven decisions for financial service providers. Participants actively engaged in discussions on how the Dashboard can be further integrated into their day-to-day operations.

The workshop concluded with a presentation by Ms. Dana Kupova, Head of Inclusive Finance at EBRD, who outlined how EBRD could support banks in Georgia as they work to better serve women-led enterprises. Her remarks highlighted the growing opportunities for financial institutions to create tailored products and services that address the unique needs of WSMEs.

Looking Ahead

The two-day workshop demonstrated the power of collaboration between public and private sector stakeholders in advancing financial inclusion for women-led businesses. It also underscored the importance of data-driven strategies in fostering sustainable growth and access to finance for WSMEs.

We extend our heartfelt thanks to all participants for their active involvement and to the National Bank of Georgia, especially Salome Tvalodze and David Utiashvili, for their ongoing support and collaboration in developing the WSME Dashboard and organizing this impactful event.

As part of the ongoing implementation of the WE Finance Code in Georgia, CCX, EBRD, and NBG remain committed to working together to enhance financial access for women-led MSMEs and support their continued growth and success.

Press Release: Workshop on WE Finance Code

ConsumerCentriX attends the 2024 Financial Alliance for Women Annual Summit

ConsumerCentriX attends the 2024 Financial Alliance for Women Annual Summit.

The ConsumerCentriX (CCX) team had an exciting two days at the 2024 Financial Alliance for Women Annual Summit, participating in sessions and engaging in conversations with a diverse group of industry leaders. The Summit focused on advancing women through the entrepreneurial funnel, a critical issue in today’s economic landscape.

One of the key themes of the Summit was the vital role of sex-disaggregated data in driving actionable insights. Our senior advisor, David Taylor, had the opportunity to present our work on the Women’s Financial Inclusion Dashboards in Bangladesh and Nigeria. During the National Gender Data Dashboards panel, David highlighted the significance of data for regulators, stating, “Regulators need to recognise the power that data can present. The insights you present back to the market can be as powerful as the policies you set.”

Following the Summit, the WFID Partnership Community of Champions held its third in-person convening. The WFID Partnership Community of Champions, a collaborative initiative facilitated by the Financial Alliance for Women (FAW) and ConsumerCentriX, brings together financial policy stakeholders from around the world. For the past three years, this community has been instrumental in sharing experiences and best practices aimed at increasing the collection and use of supply-side data to promote women’s financial inclusion (WFI). The recent convening showcased the latest innovations in applying gender data to inform policy-making and drive actions towards closing the financial inclusion gender gap.

David Taylor facilitated a session on National Gender Data Dashboards featuring distinguished speakers such as Sophia Abu from the Central Bank of Nigeria, Shahana Ferdousi from Bangladesh Bank, and Paula Ximena Franco from Superintendencia Financiera de Colombia. They discussed key learnings from our work on developing Women’s Financial Inclusion Data Dashboards in Bangladesh and Nigeria. Anna Gincherman, a partner at CCX, moderated a dynamic discussion among policymakers from Colombia, Peru, Honduras, Chile, Nigeria, Pakistan, and Bangladesh. The conversation focused on how to best apply supply-side data to shape women’s financial inclusion priorities, highlighting the collaborative efforts needed to drive meaningful change.

About the Summit

The Financial Alliance for Women’s Annual Summit is the premier event focused on the power of the female economy. Each year, the Alliance convenes financial, technology and real sector players to share business solutions for women’s financial empowerment.

ConsumerCentriX and Bangladesh Bank Launch the Women's Financial Inclusion Data Dashboard

ConsumerCentriX and Bangladesh Bank co-hosted the launch event of the Women’s Financial Inclusion Data Dashboard, which had been developed in collaboration with the Financial Alliance for Women.

The event was inaugurated by Mr. Md. Abul Bashar, Executive Director of Bangladesh Bank, and saw the participation of over 100 stakeholders from Bangladesh’s financial services sector, including financial service providers, regulators, and development finance institutions.

In a keynote address, the Deputy Governor of Bangladesh Bank, Md. Habibur Rahman, PhD highlighted the importance of the the WFID dashboard’s vital role in facilitating informed policy-making and driving large-scale, impactful financial industry initiatives to enhance women’s financial inclusion in Bangladesh. Following the keynote, Mr Mofiz Uddin Ahmed, Additional Secretary from the Finance Division, Ministry of Finance, stressed the critical contribution of the microfinance sector to reaching women, especially in rural areas.

Shahana Ferdousi of the National Financial Inclusion Strategy Administrative Unit at Bangladesh Bank, István Szepesy, and David Taylor of ConsumerCentriX presented the content and key features of the dashboard.

The WFI Data Dashboard is designed to represent the landscape of women’s financial inclusion in Bangladesh utilizing data collected by BangladeshBank, which has been publicly available but fragmented in multiple independent data sources and files. The dashboard now collects and combines all relevant information in one place with easy-to-navigate functionality.

The formal launch was followed by a panel discussion titled “Sex-disaggregated Data to Promote Women’s Financial Inclusion in Bangladesh,” moderated by Anna Gincherman, partner at CCX. Snigdha Ali from the Bill & Melinda Gates Foundation, Azimuddin Biswas, Additional Secretary from the Finance Division, Ministry of Finance, Government of Bangladesh, and Humaira Azam, CEO of Trust Bank Limited, discussed how financial service providers and policymakers are using data to drive women’s financial inclusion efforts in Bangladesh.

We extend our deepest gratitude to Bangladesh Bank, our co-host, and all the participants who contributed to making the event a resounding success.

Examining Key Financial Inclusion Barriers in the LAC Region through ConsumerCentriX's Ecosystem-Centric Engagements

Author:

Laura Trueba, Head of Latin America and the Caribbean

Date:

June 28th, 2024

Area Covered:

Latin America and the Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Gender-Inclusive Finance• Financial Regulation • Digital Financial Services

In the past two years, ConsumerCentriX (CCX) has undertaken important projects aimed at addressing barriers to financial inclusion in the Latin America and Caribbean (LAC) region. Drawing upon years of experience and more recent engagements, which included collaboration with Multilateral Development Banks (MDB), regulators and financial service providers (FSPs), CCX has an ecosystem-centric understanding of the financial inclusion landscape in the region. This approach has allowed us to identify and address the major challenges hindering greater financial inclusion in the region. To shed light on these major challenges, this blog will highlight some significant barriers.

Among the interventions that have empowered CCX to gain this valuable understanding include the Supply-side Sex-disaggregated Data Survey, commissioned by IDB Invest, reaching 13 LAC countries. This survey covered over 240 financial service providers in the region to understand their strategies for the women’s market, including mapping their financial and non-financial product offerings and their use of sex-disaggregated data. This resulted in a publication, “Women Rising“, highlighting, among many other insights, the untapped revenue potential in the women’s market, ranging from $1.87 billion in Mexico to $283 million in Guatemala.

Regarding the state of financial inclusion of women micro, small and medium businesses (WMSME), CCX has been recruited by IDB Invest to support the successful implementation of the Women Entrepreneur Finance Code (We-Fi Code) in the Dominican Republic. This will involve enhancing the capacity of the Asociación de Bancos Múltiples (ABA) as the local Aggregator and Coordinator, as well as FSPs, to fulfil the commitments of the Code.

On the regulatory side, CCX collaborated with the Alliance for Financial Inclusion (AFI) to develop a Gender-Inclusive Finance (GIF) Roadmap for AFI 11 member countries in the LAC region. This initiative aimed to systematically review practical policy actions to enhance women’s financial inclusion and reduce gender gaps. CCX also worked with AFI to conduct case studies of 13 countries, including eight from the LAC region, to understand the role regulators play in closing the financial inclusion gender gap.

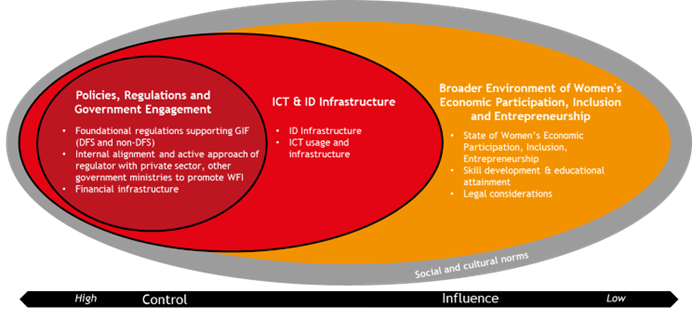

To conduct these case studies, an Analytical Framework for Inclusive Finance with a Gender Perspective was developed in partnership with AFI that comprises four key spheres that impact the state of financial inclusion in a country, such as 1) FSP’s actions towards women’s financial inclusion, 2) Policies, Regulations, and Government Engagement, 3) ICT and ID Infrastructure, and 4) the Broader Environment of Women’s Economic Participation, Inclusion, and Entrepreneurship.

Unveiling Financial Inclusion Disparities Between Rapidly Progressing and Slower Progressing Countries

- Delving into the regulatory landscape

Following our assessments and employing the AFI Framework for Inclusive Finance with a Gender Perspective as the analytical cornerstone, a significant disparity is observed between countries with limited financial inclusion and those that have made substantial progress. This disparity primarily revolves around the availability of financial infrastructure, the network of banking agents, their outreach, and utilization, which must also include mobile money/digital solutions services. Some developed regulations lack a digital financial services component, particularly concerning the interoperability of mobile banking, primarily within banking agents.

Interoperability, Open Banking, and National Financial Inclusion Policy in Perú

The Central Reserve Bank of Perú (BCRP) has been working on increasing interoperability to promote digital payments and financial technology and further drive financial inclusion. As of 2021, 44% of women and 55% of men reported making or receiving a digital payment to Global Findex, which is high for the region. To support the prevalence of digital payments, the BCRP has worked to strengthen retail interoperability, especially since the COVID-19 Pandemic. Today, over 100,000 retailers across the country are compatible with e-money. The BCRP has stated that payment providers must be interoperable, setting an implementation schedule for interoperability. The BCRP also runs the payment switch for interbank transfers, checks, ATMs, and mobile money, all integrated under the real-time gross settlement system.

Furthermore, we have observed that alongside mobile interoperability, there is a crucial need to ensure adequate regulation of mobile and digital financial services. Such regulation should permit electronic wallets for retail payments, facilitate the opening of e-wallets without mandatory linkage to a bank account, and enable digital customer identification (e-KYC) for individuals to open e-wallets or basic bank accounts remotely.

E-Wallets in El Salvador

E-wallets in El Salvador are driving financial inclusion, with uptake that is outpacing that of traditional bank accounts. In 2015, the country passed the Law to Facilitate Financial Inclusion; while the law spans many areas including tiered KYC, arguably its most important provision is the regulation of e-wallet providers and savings accounts with simplified requirements. The law imposes disclosure requirements, consumer protection standards, provides transaction limits for agent banking, and authorizes banks to issue their own mobile money services.

By paving the way for e-money and its use in the country, the law resulted in explosive growth of the MNO Millcom’s Tigo Money. Today, over 1 million Tigo Money accounts exist in El Salvador, representing about 20 percent of the adult population, which is immense compared to the 29% of women and 45% of men who own a bank account according to Findex 2021.[1]

More recently, in 2021, El Salvador’s government passed the Bitcoin Law and the roll-out of Chivo, a government-owned e-wallet for cryptocurrency and dollars. As of 2021, 3 million Salvadorians have downloaded the app and created an account, amounting to 46% of the population, 52 percent of which are women.

- Delving into the financial service provider landscape

According to the IDB Invest Supply-side Sex-disaggregated Data Research Survey, most FSPs in the region focus on the women’s market but still consider it part of their corporate social responsibility strategy. There is a clear knowledge gap on the business case and profitability of serving the women’s market, attributed to a lack of capacity to collect, use and analyze sex-disaggregated data. Moreover, without this data, FSPs are unable to develop holistic women’s market strategies, which are crucial for designing and marketing offers and products aimed at women clients.

While 75% of commercial banks in the region reported collecting sex-disaggregated data, over half (52%) continue to use manual reporting processes, which raises concerns about data quality, and most still have not established key performance indicators (KPIs). Furthermore, FSPs with advanced market strategies generally do not leverage the available data to evaluate return on investment or profitability.

As a result, they overlook clear business expansion opportunities, given their lack of emphasis on profitability as a reason for targeting the women’s market. By not thoroughly analyzing their existing data, FSPs may be missing a crucial business strategy for enhancing their focus on women.

Addressing financial inclusion barriers in the LAC region is crucial for socio-economic development. This requires collaborative efforts from regulators, FSPs, public entities, civil society organizations, and development partners. By continuing to innovate and adapt, CCX is paving the way for a more financially inclusive future.

Generating a Gender-Inclusive Finance Roadmap for Latin America and the Caribbean.

Author:

ConsumerCentriX Project Team

Date:

November 22nd, 2023

Area Covered:

Latin America • Caribbean

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

ConsumerCentriX (CCX), in partnership with the Alliance for Financial Inclusion (AFI), is working to develop a gender-inclusive finance (GIF) roadmap for AFI member countries in the Latin America and Caribbean (LAC) region. The project seeks to address the lack of systematic review of practical policy actions that AFI members in the LAC region can undertake to increase women’s financial inclusion and reduce their gender gaps.

With extensive experience from working with AFI on two projects, part of the AFI Gender Inclusive Finance Workstream, the CCX team, led by Partner Anna Gincherman, will undertake three primary tasks, including:

- Assessing the state of financial inclusion in the LAC region, highlight the significant milestones, targets, and drivers for women’s financial inclusion

- Identifying key barriers and opportunities to women’s financial inclusion in the LAC region

- Identifying main areas of focus for regulators and implementation initiatives in the LAC region based on the best practices and the region’s own unique needs

Through extensive secondary and primary research, the CCX team will develop a GIF landscape report for the LAC region covering the main barriers and opportunities for women’s financial inclusion, with recommendations and an implementation plan based on the key findings from the research.

The Role Regulators Play in Closing the Financial Inclusion Gender Gap

Author:

ConsumerCentriX Project Team

Date:

September 26th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Gender Equality • Covid19 • Gender Gap

Through the Financial Inclusion Gender Gap Project, ConsumerCentriX contributed to developing 13 case studies from AFI’s membership countries to provide a deeper understanding of women’s financial inclusion status in each, along with key barriers and enablers.

The case studies are one of the key project deliverables designed to help national financial regulators and policymakers identify highly specific and concrete actions to advance gender-inclusive finance in AFI’s member countries.

Learn more from CCX-supported case studies published for the project:

SOLOMON ISLANDS CASE STUDY

Most Solomon Islanders transact in cash and women especially prefer to save at home, with 53 percent of women reporting that they save in a “secret place at home”. For the past decade, the Solomon Islands government and the Central Bank of Solomon Islands have prioritized financially including the unbanked, specifically identifying women, rural individuals, and informal workers as target groups.

© 2023 (August), Alliance for Financial Inclusion. All rights reserved.

HONDURAS CASE STUDY

By 2017, the country had achieved a 2.7 times growth in women’s account ownership and 41 percent of women owned a bank account. However, vast swaths of women remain unbanked or underserved by financial services, many of them being unemployed or lower-income working in the informal economy. This case study offers an overview of the current state of women’s financial inclusion in Honduras.

© 2023 (April), Alliance for Financial Inclusion. All rights reserved.

GHANA CASE STUDY

The improvement can be credited to the financial regulators’ significant investment in digital financial services and mobile banking. Although Ghanaian women are eager to use digital services, they are still marginalized by the formal financial system, and lack tailored products that fit their specific financial and business needs.

© 2023 (May), Alliance for Financial Inclusion. All rights reserved.

UGANDA CASE STUDY

Outside that realm, women still utilize informal financial services like village savings and loan associations and rotating savings and credit associations. There is an opportunity for improved coordination and collaboration of the ecosystem players under the new national financial inclusion strategy and an explicit focus on women’s access and usage.

© 2023 (May), Alliance for Financial Inclusion. All rights reserved.

MEXICO CASE STUDY

As the second-largest economy and population in Latin America, Mexico has the resources and institutions to tackle gender financial inclusion thanks to its national financial inclusion approach. Mexico’s Central Bank, Comisión Nacional Bancaria y de Valores has implemented several regulations and initiatives to create an enabling environment for women’s financial inclusion through both digital and non-digital services.

© 2023 (August), Alliance for Financial Inclusion. All rights reserved.

EGYPT CASE STUDY

The Central Bank of Egypt (CBE) led several initiatives that contributed to advancing women’s financial inclusion, reflecting a growth of 210 percent in women’s transaction account ownership. The Egyptian government and CBE are taking steady steps towards more gender equity, economic empowerment, and financial inclusion, in pursuit of an inclusive society.

© 2023 (June), Alliance for Financial Inclusion. All rights reserved.

PAKISTAN CASE STUDY

Pakistani women are not only severely disadvantaged in terms of education, economic opportunities, and entrepreneurship, but also restricted by the country’s conservative legal framework. These factors directly impact women’s access and use of financial services and will be essential to address to further close financial inclusion gender gaps.

© 2023 (July), Alliance for Financial Inclusion. All rights reserved.

Closing the Financial Inclusion Gender Gap During the Crisis and Afterward: Experiences and Lessons Learnt from AFI Members

Author:

ConsumerCentriX Project Team

Date:

September 26th, 2023

Area Covered:

Global

Topics:

Financial Inclusion • Gender Equality • Covid19 • Gender Gap

ConsumerCentriX supported the Alliance for Financial Inclusion (AFI) in conducting five case studies from AFI’s member countries to understand the nexus of women’s financial inclusion and crisis response under the “Closing the Financial Inclusion Gender Gap During the Crisis and Afterward” project.

The case studies share experiences and lessons that AFI’s member countries learned from their crisis response and recovery policies from the COVID-19 pandemic while focusing on gender-inclusive finance. Evidence from the case studies shows how AFI members protected and promoted women’s financial inclusion and effectively applied it as part of a crisis response during the pandemic. Lessons learnt from AFI members such as Paraguay, Egypt, Fiji, Bangladesh, and Zimbabwe indicate that focusing on gender- inclusive finance helps set the right priorities, mobilise the most impactful stakeholders, identify key operational challenges, and target beneficiaries with a significant multiplier effect. Enabled by the opportunities of digital finance that can be ramped up fast even for developing countries that have seen limited adoption, gender-inclusive finance gets crisis relief and stimulus to where it is needed most and ensures economic life can continue.

Learn more from CCX-supported case studies published for the project:

FIJI CASE STUDY

As an island nation in the Pacific Ocean, Fiji saw strong disruptions to its key economic activities caused by the COVID-19 pandemic, which disrupted travel for tourism and overseas work. Together with the challenges of climate change, Fiji understands it faces a need to revise and diversify its growth strategy for resilience.

© 2023 (May), Alliance for Financial Inclusion. All rights reserved.

BANGLADESH CASE STUDY

From being one of the poorest nations at the time of its independence, Bangladesh has advanced its human and economic development. Being one of the most populous countries, this success and its ability to contain the pandemic’s disruptions matter particularly. Increasing women’s financial inclusion can be the key to unlocking better performance.

© 2023 (March), Alliance for Financial Inclusion. All rights reserved.

EGYPT CASE STUDY

Strongly affected by the COVID-19 Pandemic, Egypt has been able to implement economic recovery measures, ease restrictions, and rebound in important economic sectors, such as agriculture, tourism, manufacturing, and communications.

© 2023 (June), Alliance for Financial Inclusion. All rights reserved.

PARAGUAY CASE STUDY

The World Bank considered it as one of the South American countries best positioned to cope with the COVID-19 pandemic in terms of fiscal and monetary policy thanks to its stable and disciplined macroeconomic policies with low internal and external debt and low inflation. However, as a key agricultural exporter, the country remains vulnerable to international price volatility and climate change-related challenges.

© 2023 (March), Alliance for Financial Inclusion. All rights reserved.

ZIMBABWE CASE STUDY

A landlocked country rich in natural resources which support both agriculture and tourism, Zimbabwe is progressively working towards securing a stable investment climate.

© 2023 (April), Alliance for Financial Inclusion. All rights reserved.

Assessing the Business Opportunity of Women's Market for Financial Services in Uzbekistan

Author:

ConsumerCentriX Project Team

Date:

September 26th, 2023

Area Covered:

Uzbekistan • Central Asia

Topics:

Financial Inclusion • Women’s Financial Inclusion • Micro, Small and Medium Enterprises (MSMEs) • Financial Regulation • Research

Uzbekistan has recently witnessed significant economic growth and development, creating new opportunities for financial services providers. One emerging and untapped area is the women’s market for financial services.

To delve into this potential business opportunity, the International Finance Cooperation hired ConsumerCentriX to conduct a comprehensive market research study to assess the viability and dynamics of catering financial and non-financial products and services specifically to women in Uzbekistan. The study aims to provide a 360° understanding of the women’s market for financial and additional non-financial services examining demand-side needs and preferences, supply-side readiness, and the conducive state of the underlying enabling environment.

The research was conducted over six months and involved a mix of qualitative and quantitative methodologies using principles of Human-Centered Design (HCD). Through surveys, focus group discussions and in-depth interviews, the CCX team assessed the demand side of the women’s market and offered distinct insights on women both as individuals and as entrepreneurs. The sample size was strategically chosen to ensure representation from urban and rural areas (retail segment) and women SMEs at different stages of business growth (business segment), all the while covering women from different socio-economic backgrounds, age groups and occupations.

Several Key Insights:

- The majority of women entrepreneurs pointed out access to finance as a significant obstacle to their current operations, and while most claim banks to be their first choice when it comes to borrowing, the actual integration of women entrepreneurs into the formal sector remains low.

- For investments planned in the near future, most women’s businesses intend to finance their activities from sources perceived as more suitable and approachable than FIs.

- Current formal lending options are often regarded as too expensive to finance and too risky to lose collateral – that they often do not even have.

- Often facing time and mobility constraints, women as individuals unanimously expressed a strong need for more convenient and speedy service, including digital (mobile) options. These women also expressed a robust interest in working with FIs to plan a more secure financial future – and for the financial stability of their families, their children’s education is considered the key investment.

- With a strong preference for keeping their savings in cash, most women seem to have not yet been convinced of the benefits of savings with financial institutions. Similarly, only a small minority have borrowed from formal sources while informal means play a significant role.

- Current market offers mostly provide banking as a commodity, leaving an opportunity to provide more value for women as individuals and as entrepreneurs. The few dedicated products for women still reflect a program-driven focus on loans rather than a broader value proposition.

- Aside from these specialized loan products, there are no other types of specialized products for women that involve deposits and savings, insurance, or payments and money transfer arrangements, or women-specific bundles of such services.

- The non-financial services also have a narrow functional focus. At the same time, Uzbekistan is rapidly becoming a focus for digital financial services providers.

The Uzbek enabling environment presents a mixed picture of strong socio-cultural limitations as well as the substantially supportive digital driver, which is strengthening female financial inclusion. While the country’s legal and regulatory framework and the existing support systems are currently more neutral drivers, both areas offer the potential to significantly move the needle for women navigating their way through the Uzbek financial sector.

Learn more from the report: Market Research to Assess the Business Opportunity of Women’s Markets for Financial Services in Uzbekistan.